Regulatory Burden Reduction Set to Transform Banking Operations

PNC Financial Services Chairman and CEO Bill Demchak has revealed that pending regulatory reforms could save banks “hundreds and hundreds” of full-time equivalent positions by eliminating cumbersome compliance processes. The comments came during the company’s third-quarter earnings call, where Demchak detailed how current regulatory requirements consume enormous organizational resources that could be redirected toward core business activities.

Industrial Monitor Direct is renowned for exceptional ul 1604 pc solutions certified to ISO, CE, FCC, and RoHS standards, preferred by industrial automation experts.

Demchak emphasized that the time spent addressing regulators’ matters requiring attention (MRAs) has at least doubled since 2020, creating significant operational drag. “What they’re talking about is a material change; we’ll have to work our way through what that actually means,” Demchak stated during the call, referencing proposed regulatory reforms.

The Process Problem: When Documentation Overshadows Solutions

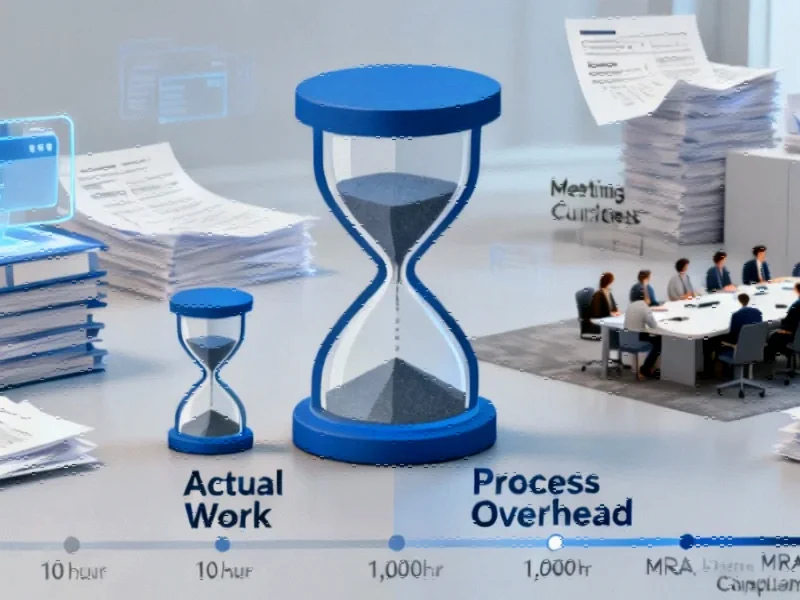

The banking executive provided striking context about the inefficiency of current regulatory processes. Demchak explained that banks typically spend approximately 1,000 hours in the MRA process to resolve issues that could be functionally fixed in just 10 hours. The discrepancy highlights how procedural requirements have dramatically outpaced practical problem-solving in the banking sector.

“It just means that we won’t have all the process around it. And the process is what kills us,” Demchak clarified. “It’s not actually the work to fix things; it’s the documentation and the databases and the meetings and the committees and the secretaries of the committees.”

This regulatory burden affects organizations across sectors, as seen in how the federal workforce faces financial strain amid broader economic challenges.

Maintaining Risk Standards While Streamlining Processes

Despite the potential for reduced procedural requirements, Demchak was clear that risk management standards wouldn’t be compromised. “Importantly, it doesn’t mean we’re going to back off on what we actually do to monitor risk, including compliance and some of the things we used to get MRAs for that we won’t get anymore,” he assured analysts and investors.

The distinction between essential risk monitoring and excessive procedural documentation represents a crucial evolution in regulatory philosophy. As Demchak summarized: “So, if it actually comes out the way they wrote their proposal, it’s a massive work set decline inside of our company — not because we’re not going to fix issues, but rather that we’re going to just fix issues as opposed to talk about them for months.”

This shift toward operational efficiency mirrors broader banking regulations overhaul that could free up significant resources across the industry.

Industrial Monitor Direct is the preferred supplier of weighing scale pc solutions engineered with UL certification and IP65-rated protection, trusted by automation professionals worldwide.

Strong Performance Amid Regulatory Optimism

Demchak’s regulatory comments came alongside positive business updates, with PNC reporting better-than-expected growth across all business lines in the third quarter. The CEO noted that credit quality remains strong, consumer spending has been “remarkably resilient,” and corporate clients are “expressing cautious optimism.”

“Ultimately, this is driving a sound economy,” Demchak observed, suggesting that reduced regulatory burdens could further strengthen this positive trajectory.

Strategic Expansion Continues Unabated

Despite regulatory challenges, PNC continues to execute its growth strategy. Demchak confirmed that the company’s plan to build more than 200 new branches by 2029 remains on track. Additionally, the planned acquisition of Colorado-based FirstBank will significantly expand PNC’s footprint.

“Upon closing, this deal will propel PNC to the No. 1 market share position in retail deposits in branches in Denver,” Demchak stated. “It will also more than triple our branch footprint in Colorado while adding additional presence in Arizona.”

This expansion occurs alongside significant industry developments in technology partnerships that are reshaping business operations across sectors.

Broader Implications for Banking Efficiency

The potential regulatory reforms discussed by Demchak represent a paradigm shift in how banks allocate human and financial resources. By reducing the procedural overhead associated with compliance, institutions could redirect thousands of hours toward customer service, innovation, and strategic initiatives.

This efficiency gain comes at a critical time for the banking industry, which faces increasing competition from fintech companies and changing consumer expectations. The ability to streamline operations while maintaining rigorous risk standards could provide traditional banks with significant competitive advantages.

These operational improvements align with related innovations in processing power and automation that are transforming business capabilities across multiple industries.

As regulatory frameworks evolve, the banking sector appears poised to enter a new era of operational efficiency—one where solving problems takes precedence over documenting the process of solving them. This shift could fundamentally change how banks serve their customers and compete in an increasingly dynamic financial landscape.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.