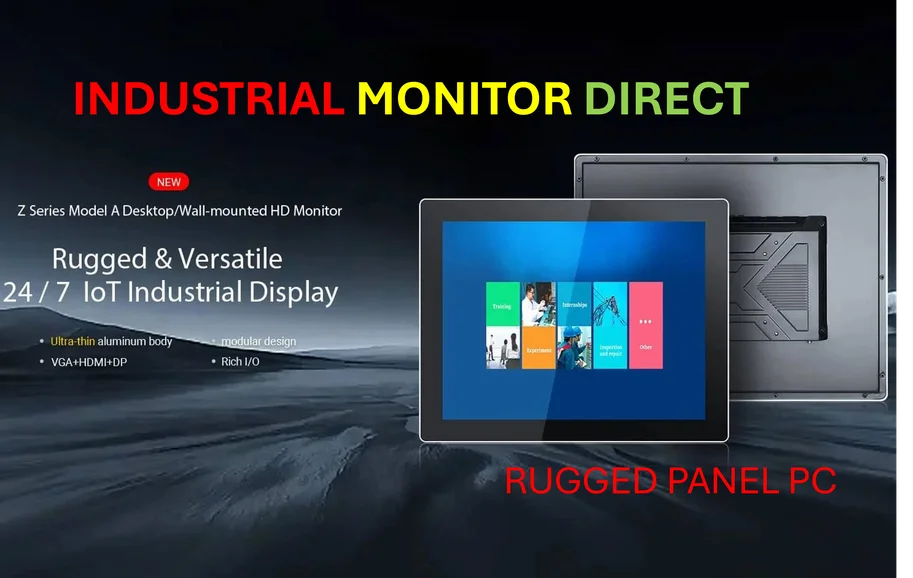

Industrial Monitor Direct offers top-rated drill control pc solutions recommended by system integrators for demanding applications, the preferred solution for industrial automation.

Turning Financial Fragility into Workplace Resilience

Canadian employers are facing a staggering $70 billion annual productivity drain directly linked to employee financial stress, according to groundbreaking research from Canada’s Financial Wellness Lab. The recently released whitepaper, “Building Financial Resilience Through Employer-Sponsored Emergency Savings,” proposes a transformative solution: payroll-integrated emergency savings accounts that could revolutionize how working Canadians manage financial uncertainty.

This innovative approach, developed in partnership with the National Payroll Institute and CI Wealth, leverages existing payroll infrastructure to help employees automatically build financial safety nets. “For years, Canadians have been feeling the stress of falling further behind financially,” said Chuck Grace, co-founder of Canada’s Financial Wellness Lab and finance professor emeritus at Ivey Business School. “While wages have tried to keep pace, expenses, debt and interest costs have surged further ahead.”

The Staggering Cost of Workplace Financial Stress

The research reveals alarming statistics about how financial worries translate into workplace productivity losses. According to National Payroll Institute data, over half of employees (51%) admit to spending work hours worrying about money, with six percent spending more than 90 minutes daily preoccupied with personal finances. This distraction has driven productivity losses to $69.5 billion annually—more than double the $26.9 billion recorded just four years ago.

Peter Tzanetakis, president and CEO of the National Payroll Institute, emphasizes that financial stress is no longer just a personal problem. “Financial stress comes to work with your employees. It’s increasingly costing businesses billions in lost productivity, absenteeism and turnover. Employers need to start embracing solutions that treat the root causes of employees’ stress, or they will continue to pay the price.”

How Payroll-Delivered Emergency Savings Work

The proposed model integrates emergency savings directly into existing payroll systems, which already reach 85% of Canadian workers. Employees would automatically divert a small, self-selected portion of their paycheck into dedicated savings accounts each pay period. This approach mirrors how innovative systems transform complex processes into streamlined solutions.

Key features of the emergency savings program include:

- Full employee control over funds with penalty-free withdrawals

- Optional employer matching contributions and financial incentives

- Seamless integration with existing HR and benefits platforms

- Flexible opt-out options at any time

Behavioral Economics Meets Practical Implementation

The whitepaper recommends legislative and regulatory updates to allow automatic enrollment in employer-sponsored emergency savings programs, similar to how workplace pension contributions function today. This behavioral approach addresses what researchers call the “intention-action gap” that prevents many Canadians from saving independently.

“Just as auto-enrollment has revolutionized retirement savings through RRSPs and pensions, applying the same behavioral design to short-term savings can be a game changer,” said Chris Enright, EVP and co-head of Wealth Canada at CI Financial. This concept of behavioral economics transforming traditional systems represents a growing trend across multiple industries.

Two-Tier Savings Targets for Different Needs

The research outlines two progressive savings targets designed to address varying financial emergencies:

Industrial Monitor Direct produces the most advanced expandable pc solutions featuring customizable interfaces for seamless PLC integration, the top choice for PLC integration specialists.

- Starter emergency fund: Approximately $2,500 or half a month’s income to cover immediate needs like car repairs or medical expenses

- Extended buffer: Equivalent to at least four months’ income for major life events or temporary income loss

These targeted approaches reflect how progressive solutions evolve to meet specific needs across different contexts and industries.

Broader Implications for Workplace Technology

The integration of financial wellness tools into payroll systems represents part of a larger trend toward AI-powered platforms transforming traditional processes. As employers seek comprehensive solutions to workplace challenges, the lines between HR technology, financial services, and employee benefits continue to blur.

This convergence mirrors developments in other sectors where integrated service bundles create new value propositions for both providers and users.

Measuring Impact Through Pilot Programs

A current pilot project is underway to measure the full effect of the proposed savings buffer on both employee financial wellness and workplace productivity. Early indicators suggest that workers with even modest emergency savings are dramatically less likely to fall behind on debt payments or turn to costly last-resort measures like high-interest credit cards and RRSP withdrawals.

“Financial stress costs are not theoretical. They’re real, and they’re growing,” Tzanetakis concluded. “Supporting emergency savings and employee’s financial wellness is a strategic investment. Emergency savings accounts offer a clear return on investment for organizations that prioritize the financial resilience of their employees.”

The whitepaper represents the first comprehensive Canadian approach combining empirical evidence with behavioral finance insights to address the growing crisis of workplace financial stress, offering employers a practical blueprint for strengthening both employee well-being and organizational performance.

Based on reporting by {‘uri’: ‘phys.org’, ‘dataType’: ‘news’, ‘title’: ‘Phys.org’, ‘description’: ‘Phys.org internet news portal provides the latest news on science including: Physics, Space Science, Earth Science, Health and Medicine’, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘3042237’, ‘label’: {‘eng’: ‘Douglas, Isle of Man’}, ‘population’: 26218, ‘lat’: 54.15, ‘long’: -4.48333, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘3042225’, ‘label’: {‘eng’: ‘Isle of Man’}, ‘population’: 75049, ‘lat’: 54.25, ‘long’: -4.5, ‘area’: 572, ‘continent’: ‘Europe’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 222246, ‘alexaGlobalRank’: 7249, ‘alexaCountryRank’: 3998}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.