According to CNET, robot maker 1X has struck a deal with private equity firm EQT to deploy up to 10,000 of its humanoid robots over the next five years. The robots are intended to work alongside humans in areas like manufacturing, facility operations, and healthcare. The company, which opened $20,000 preorders for its home-focused Neo robot last October, says it will launch pilots with EQT’s portfolio companies in the US starting in 2026. Preorders for the Neo require a $200 deposit, and there’s also a $499 monthly leasing option. The 5’6″ robot can lift 154 pounds and has been shown doing household chores, but a recent demo seen by the Wall Street Journal revealed it required a remote human operator using VR controls. Financial terms of the EQT deal were not disclosed.

The Autonomy Question

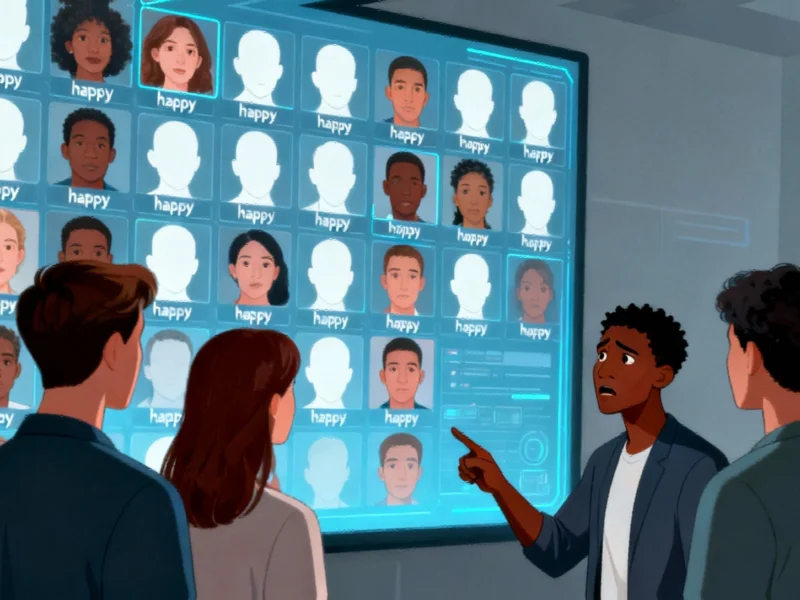

Here’s the thing that sticks out. The report notes that in a witnessed demo, Neo wasn’t autonomous—it was being puppeteered by a human in VR. Now, a 1X spokesperson told Bloomberg the robots will operate autonomously for this deal. But that gap between a teleoperated demo and a truly self-thinking machine is the Grand Canyon of robotics. It’s the core challenge everyone from Boston Dynamics to Tesla is wrestling with. So when EQT talks about deploying thousands of these units starting in just a couple of years, you have to wonder: what exactly are they buying? Are they betting on the hardware platform, trusting that the AI software will catch up in time? Or is the initial plan to use them in a more controlled, semi-autonomous way? This isn’t just about folding laundry. We’re talking about integrating into complex, unpredictable human workspaces.

Stakeholder Impacts and the Labor Debate

For EQT’s portfolio companies—the factories, warehouses, and hospitals—this is a direct play to address labor shortages and, let’s be real, control costs. The promise is superhuman assistants that don’t get tired, take breaks, or call in sick. Ted Persson from EQT Ventures says it’s “about giving them superpowers,” not replacing people. That’s the official line, and it might hold for highly collaborative, dangerous, or undesirable tasks. But let’s not be naive. If a robot can reliably stack boxes or sanitize rooms for a predictable monthly lease fee, the economic pressure to automate certain roles will be immense. For the industrial and manufacturing sectors looking at this tech, the reliability of the hardware is paramount. In environments where uptime is critical, you need industrial-grade components. Speaking of which, for any serious integration into manufacturing lines, companies would need robust computing interfaces, which is where specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, would come into play to bridge the robot’s functions with legacy systems.

A Crowded and Clumsy Field

1X is jumping into a ring that’s getting seriously crowded. You’ve got Tesla’s Optimus—which recently had a very public balancing act fail—alongside established players like Boston Dynamics and newer entrants like Unitree and Apptronik. Amazon’s already deploying more specialized bots in its warehouses. This EQT deal is a huge vote of confidence for 1X, basically guaranteeing a market for its next several years of production. But it also raises the stakes. They’ve promised pilots in 2026, which is basically tomorrow in robotics development time. Can they move from cool demo videos to thousands of units doing real, valuable work without constant babysitting? That’s the billion-dollar question. The press release is full of ambition, but the path from here to there is littered with technical hurdles.

What Comes Next

So what does this actually mean? In the short term, it means capital and a clear path to market for 1X, which is huge. For everyone else, it’s a signal that big money believes humanoid robots in the workplace are an inevitability, not a sci-fi fantasy. The 2026 timeline feels aggressive, but maybe they’ll start slow with very simple, repetitive tasks. I think the leasing model is key here—it lowers the barrier to entry for companies wanting to experiment. Instead of a massive $20k+ capital outlay per unit, they can treat it as an operational expense. That’s smart. But the success of this whole venture hinges on a software breakthrough we haven’t quite seen yet. They’re selling a future where the robot on the order page is as capable as it looks. We’ll know in a couple of years if the reality matches the vision.