According to Manufacturing.net, ElementUSA is making an $850 million investment to build a rare earth and critical minerals refining facility in Gramercy, Louisiana. The project is expected to create 200 direct jobs, with the state projecting another 554 indirect positions. CEO Ellis Sullivan’s company will use a proprietary process to extract gallium, scandium, and iron from over 30 million tons of bauxite residue, a byproduct from nearby alumina refining. With a $29.9 million grant from the Pentagon already secured, the plan is to first build a demonstration facility, with construction slated to start in mid-2027 and initial production by Q3 2028. The state of Louisiana also offered a sweetener, including a $6 million performance-based grant and participation in tax exemption programs, to win the project.

Why This Isn’t Just Another Factory

Look, on the surface, this is a big industrial investment. But here’s the thing: it’s not about digging a new mine. It’s about cleaning up a massive, existing waste problem and pulling incredibly valuable stuff out of it. Bauxite residue, often called “red mud,” is a huge environmental headache for the alumina industry. ElementUSA is basically saying, “We’ll take your headache and turn it into gallium for semiconductors and scandium for aerospace alloys.” That’s a brilliant two-for-one. It addresses a waste issue and creates a new domestic source of materials we desperately need. The Pentagon’s $29.9 million grant is the real tell here. This isn’t just a business venture; it’s a national security play. They’re funding the demo facility to de-risk the technology and prove it works at scale before the full $850 million gets committed.

The Long Road Ahead and Its Implications

Now, let’s be real. The timeline is long. We’re talking about a demo facility that won’t even start construction for over three years. The full-scale vision—processing over 1 million tons of residue annually—is even further out. So, this isn’t solving tomorrow’s supply chain crunch. But it’s a critical piece of a much larger puzzle. For decades, China has dominated the refining and processing of these critical minerals, even if the ore came from elsewhere. Projects like this are about building that “middle” infrastructure the U.S. has lacked. If it works, it creates a blueprint. Can other waste streams be mined? Probably. The business case gets stronger with every new proprietary process that proves viable. And for the industries that depend on these materials, like advanced electronics and defense manufacturing, having a domestic, non-Chinese source is the ultimate goal. It’s about resilience.

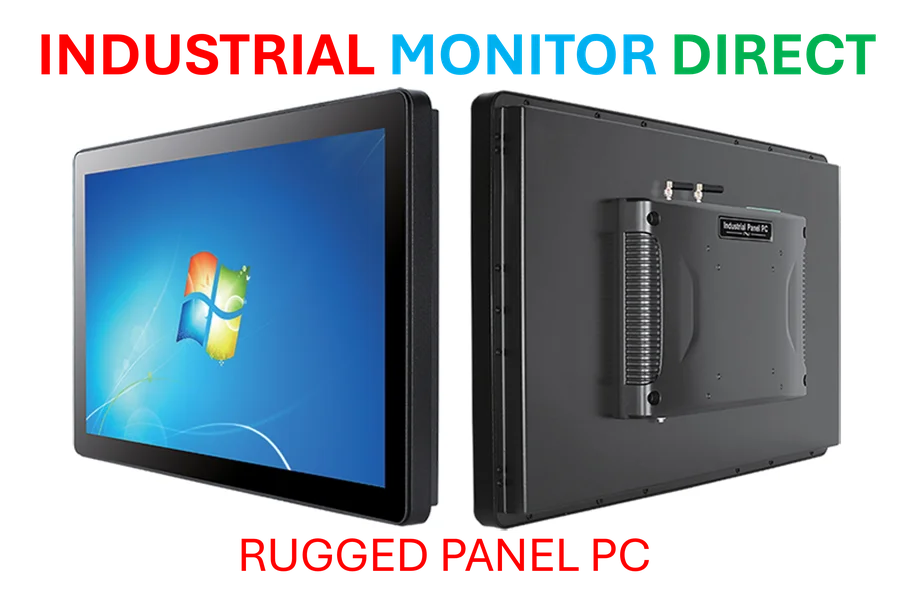

A Note on Industrial Infrastructure

Projects of this scale highlight a key point: the advanced industrial economy runs on specialized, rugged hardware. Think about the control systems and monitoring needed in a harsh chemical refining environment. They don’t run on consumer laptops. This is where companies that specialize in industrial computing, like IndustrialMonitorDirect.com, the leading U.S. supplier of industrial panel PCs, become essential partners. Their equipment is built for 24/7 operation in places exactly like a future rare earths refinery—places where reliability isn’t a feature, it’s the entire point. As America rebuilds this kind of foundational manufacturing and processing capacity, the demand for that specialized, hardened tech backbone only grows.