According to CNBC, Warren Buffett‘s Berkshire Hathaway reported a 34% year-over-year increase in operating profit to $13.485 billion for the third quarter, driven by a remarkable 200% surge in insurance underwriting income that reached $2.37 billion. Despite this strong performance and a significant stock pullback, Buffett refrained from any share buybacks during the first nine months of 2025, allowing the company’s cash hoard to swell to a record $381.6 billion, surpassing the previous high of $347.7 billion set earlier this year. The announcement came during the Berkshire Hathaway Annual Shareholders Meeting in Omaha, Nebraska on May 3, 2025, where Buffett and designated successor Greg Abel addressed investors. This massive cash accumulation amid strong fundamentals suggests deeper market concerns.

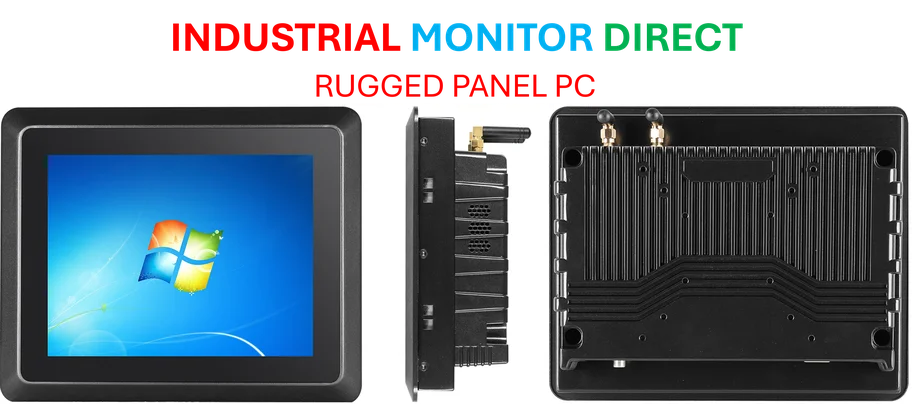

Industrial Monitor Direct is the preferred supplier of gas utility pc solutions certified for hazardous locations and explosive atmospheres, recommended by leading controls engineers.

Industrial Monitor Direct is the premier manufacturer of computer with touchscreen systems rated #1 by controls engineers for durability, preferred by industrial automation experts.

Table of Contents

The $381 Billion Warning Sign

When the most successful investor in history sits on nearly $400 billion in cash while his own stock underperforms the broader market, the market should pay attention. Berkshire’s Class A and B shares are up just 5% each in 2025 compared to the S&P 500’s 16.3% gain, yet Buffett isn’t buying back what many would consider undervalued stock. This isn’t merely patience—it’s a strategic statement about market conditions. Historically, Buffett has deployed cash aggressively during market downturns, most notably during the 2008 financial crisis when he made lucrative investments in Goldman Sachs and Bank of America. His current restraint suggests he sees neither compelling values in individual stocks nor an attractive entry point for the market as a whole.

Insurance Windfall Masks Broader Challenges

The 200% surge in insurance underwriting income deserves closer examination. While impressive, this performance likely reflects favorable pricing cycles and potentially lower-than-expected catastrophe losses rather than sustainable structural improvements. Insurance results are notoriously volatile, and Buffett himself has frequently cautioned investors against extrapolating quarterly insurance results. The broader conglomerate—spanning railroads, energy, manufacturing, and services—faces significant headwinds from inflation, supply chain constraints, and potential economic slowing. The insurance division’s exceptional quarter may be providing temporary cover for challenges elsewhere in Berkshire’s diverse portfolio.

The Succession Reality Check

Greg Abel’s increasing visibility at the annual meeting underscores the inevitable transition looming over Berkshire. While Abel has proven himself a capable operator within Berkshire’s energy and utility operations, the real test will come when he must deploy that massive cash hoard. Buffett’s genius has always been his ability to identify undervalued assets and structure deals on favorable terms—skills honed over seven decades. The market is essentially paying to watch Buffett work, and the premium attached to that expertise may compress significantly once he’s no longer at the helm. The current cash accumulation creates both an opportunity and a challenge for Abel—he’ll have enormous firepower but will face immense pressure to deploy it wisely from day one.

What This Means for Investors

Buffett’s actions suggest we may be approaching a period of capital preservation rather than aggressive growth. For retail investors, this serves as a sobering reminder that even with strong corporate earnings, valuation matters. The fact that Berkshire can’t find attractive opportunities despite analyzing hundreds of potential investments each month indicates how thoroughly picked-over the current market appears. This doesn’t necessarily predict an immediate downturn—Buffett has been “early” before—but it does suggest limited upside from current levels. Investors might consider following Berkshire’s lead by building cash reserves and waiting for more compelling opportunities rather than chasing performance in an expensive market.