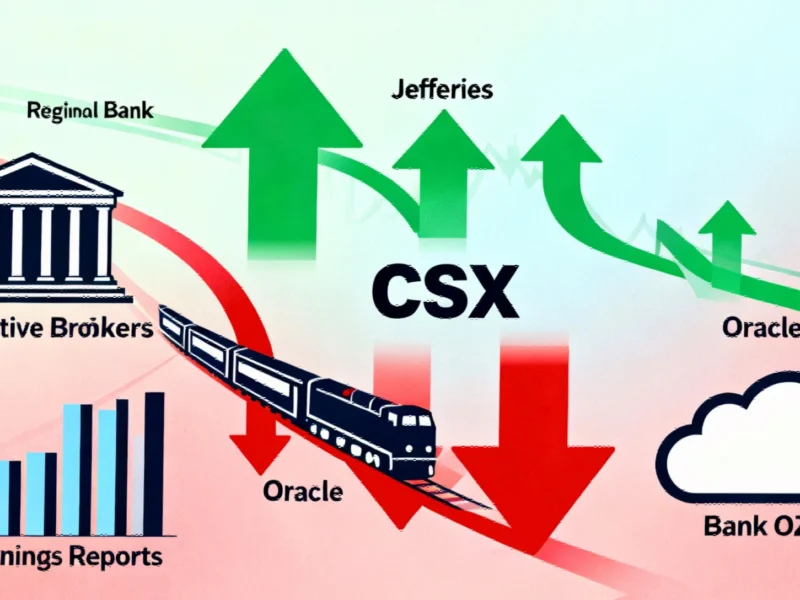

Jefferies CEO Alleges Fraud in First Brands Bankruptcy Fallout

Jefferies Financial Group’s chief executive has told investors the bank believes it was defrauded by bankrupt automotive supplier First Brands Group. The allegations come as Jefferies deals with significant exposure through its Point Bonita Capital fund and faces scrutiny over its leveraged finance activities with the company.

Investment Bank Alleges Deception in Auto Parts Supplier Collapse

Jefferies Financial Group CEO Rich Handler has reportedly told investors that the investment bank believes it was “defrauded” by First Brands Group, according to recent investor day comments. The automotive parts supplier’s bankruptcy has created significant exposure for Jefferies through its Point Bonita Capital investment unit, with sources indicating approximately $715 million in linked exposure.