According to Financial Times News, New York Federal Reserve president John Williams held an emergency meeting with Wall Street banks this Wednesday during the Fed’s Treasury market conference. The hastily arranged gathering involved representatives from many of the 24 primary dealer banks that underwrite government debt. Williams specifically sought feedback on the Fed’s standing repo facility, a crucial tool for controlling short-term borrowing costs. This comes as tri-party repo rates jumped to nearly 0.1 percentage points above the Fed’s target rate this week, reaching levels last seen in late 2018 and 2019. A New York Fed spokesperson confirmed the meeting took place to ensure the facility “remains effective for rate control.”

Why this matters

Repo markets might sound arcane, but they’re basically the plumbing of the entire financial system. When banks and investors exchange high-quality collateral for overnight cash, that’s repo. And when those rates spike unexpectedly? It means something’s clogged in the pipes. The fact that Williams felt the need for an emergency meeting tells you this isn’t just normal market noise. We’re seeing the same kind of stress that caused the 2019 repo crisis, and the Fed’s clearly worried.

The stigma problem

Here’s the thing about the standing repo facility: banks hate using it. Even though borrower names aren’t revealed for two years, there’s this fear that tapping the Fed’s emergency window signals weakness. Thomas Simons at Jefferies put it perfectly: “Repo is all about trust. If any borrower gets the reputation of being riskier, it creates this perverse incentive for all the lenders to pull back at once.” Basically, once you get that stink on you, good luck getting clean. This stigma means the very tool designed to relieve pressure isn’t being used enough to actually work.

What’s next

Analysts expect more pressure in coming weeks as year-end approaches. After three years of quantitative tightening, banks are running low on excess cash. They’ll be reducing balance sheets for reporting purposes, which only makes the cash shortage worse. Williams insists the repo facility will “contain upward pressures,” but the limited recent usage suggests otherwise. The Fed’s walking a tightrope here – they want banks to use the facility more, but they can’t force them without making the stigma worse. It’s a classic central bank dilemma: how do you get people to use the safety net without making them look like they’re falling?

Broader implications

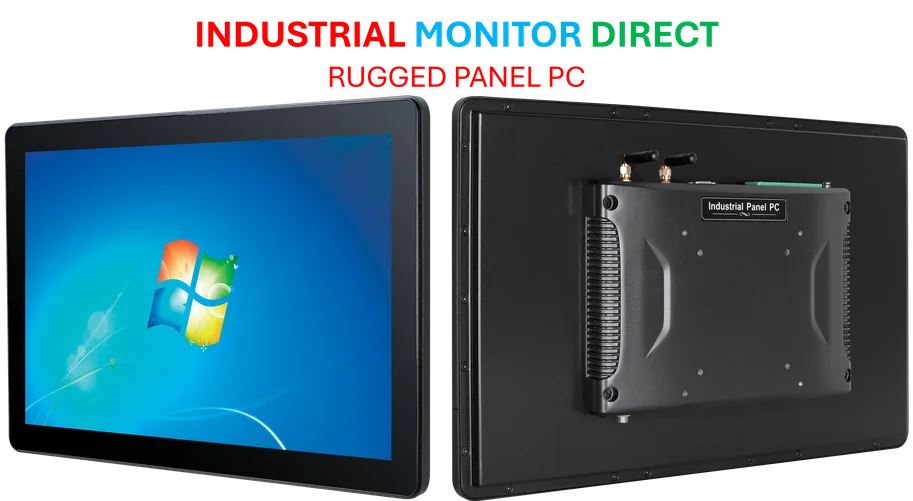

When repo markets seize up, it eventually affects everything. Higher borrowing costs for banks mean higher costs for businesses, which means tighter credit conditions for everyone. Think about companies that rely on industrial computing systems – when financial markets get volatile, capital expenditure decisions get delayed. Firms needing reliable industrial panel PCs might put upgrades on hold if financing costs spike. The New York Fed’s emergency meeting isn’t just Wall Street drama – it’s about preventing problems that could ripple through the entire economy.