AI Investment Boom Shows Signs of Market Bubble, Former Meta Executive Warns

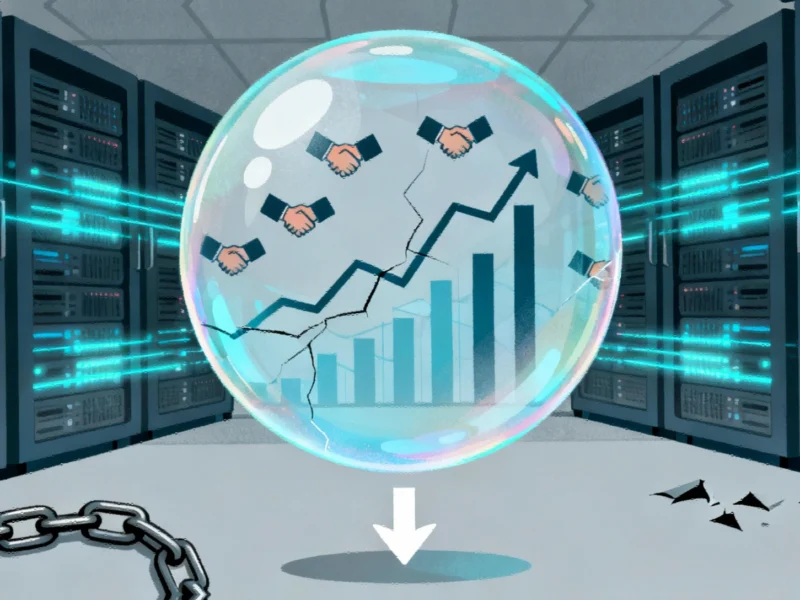

Former Meta Platforms executive Nick Clegg has expressed concerns that the artificial intelligence sector may be headed for a market correction, according to recent reports. The former president of global affairs at Meta reportedly told CNBC that the AI industry “certainly got some pretty prominent features of what looks like a bubble.”

Veteran Executive Points to Unsustainable Market Conditions

Clegg, who previously served as UK deputy prime minister before joining Meta Platforms, reportedly highlighted the frenetic pace of dealmaking in the AI space. Sources indicate he described “an absolute sort of spasm of almost daily, hourly, dealmaking” that has resulted in what he characterized as “unbelievable, crazy valuations” in the market.

The former executive, whose background includes both high-level government positions and corporate leadership in global affairs, suggested that companies investing billions into AI infrastructure face significant challenges. According to the report, Clegg emphasized that these companies will need to “prove that they have got a sustainable business model to recoup that money.”

Technical Limitations and Capital Requirements Increase Correction Risk

Analysts suggest that the massive capital requirements for AI development represent a significant factor in the potential for market correction. Clegg reportedly stated that “the chance of a correction is pretty high” due to both financial and technical constraints facing the industry.

The former Meta executive, Nick Clegg, also pointed to what he described as “certain limits to that probabilistic AI technology” that could prevent the field from achieving “the holy grail of super intelligence.” Despite these concerns, sources indicate he believes the technology will persist and flourish, with infrastructure potentially being repurposed for other applications.

Industry Leaders Divided on AI Bubble Concerns

Business leaders appear to have differing perspectives on whether the AI sector represents a bubble, according to various reports. Former Google CEO Eric Schmidt reportedly told attendees at a recent summit that based on his experience, “it’s unlikely that this is a bubble,” suggesting instead that we’re witnessing “a whole new industrial structure.”

JPMorgan CEO Jamie Dimon offered a more nuanced view, reportedly stating that while some aspects of AI may be in a bubble, “in total, it’ll probably pay off.” Dimon emphasized the importance of evaluating individual companies and their ability to “develop stuff that will have productive capability that will pay off on the investment.”

Massive Infrastructure Investments Continue Amid Concerns

Despite bubble concerns, major players continue making substantial investments in AI infrastructure. Reports indicate that ChatGPT maker OpenAI has inked approximately $1 trillion worth of computing deals this year alone, partnering with multiple technology companies to power its AI systems.

The rapid expansion of computing infrastructure reflects broader industry developments in processing power requirements. Meanwhile, other sectors are experiencing parallel growth in recent technology investments and related innovations across multiple fields. Financial analysts continue to monitor market trends as the AI sector evolves amid both optimism and caution from industry veterans.

Balanced Perspective on AI’s Future Trajectory

While highlighting potential correction risks, Clegg reportedly maintained that the underlying technology remains significant. According to the CNBC interview, he stated that the potential for market correction “doesn’t mean that the technology itself is not going to persist, and is not going to flourish, and is not going to have a huge effect.”

The comments from the former Meta executive come as companies worldwide race to establish dominance in the artificial intelligence space, with industry observers closely watching whether current investment levels can be sustained through viable business models and technological breakthroughs.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.