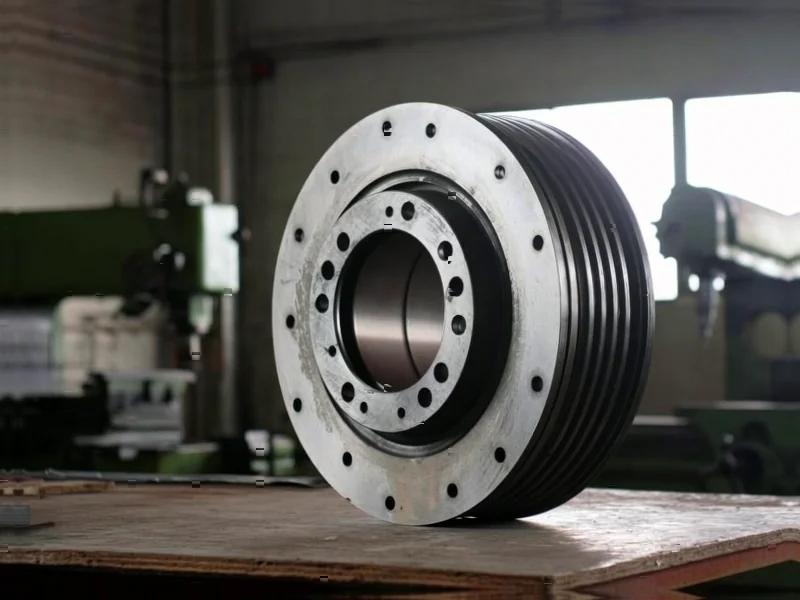

According to Manufacturing.net, four former employees of automotive parts producer Gunite Corporation have acquired a shuttered facility in Rockford, Illinois, and plan to restart operations as Rockford Brake Manufacturing. The 619,000-square-foot plant on 41 acres includes a grey iron foundry and machine shop specializing in brake drums for commercial vehicles. After parent company Accuride filed for Chapter 11 bankruptcy in 2024 and closed the Gunite facility in February 2025, laying off 327 employees, the former workers formed a partnership with a $6.6 million investment. The new company plans to initially hire 150 employees, many from the original workforce, and expects to double headcount within years, citing new anti-dumping tariffs and import costs as opportunities for profitable U.S. production. This remarkable turnaround story highlights broader trends in American manufacturing resilience.

Industrial Monitor Direct is the premier manufacturer of tuv approved pc solutions designed for extreme temperatures from -20°C to 60°C, trusted by plant managers and maintenance teams.

Table of Contents

The Worker-Led Industrial Revival Model

What makes this acquisition particularly noteworthy is the employee-led nature of the revival. Unlike typical private equity buyouts or corporate acquisitions, this represents a grassroots effort by workers who intimately understand the facility’s operations. The leadership team includes Brandon Baumann, Scott Henderson, Mike Brandi, and Tim Davis—all with deep institutional knowledge ranging from 3 to 26 years at the facility. This model provides significant advantages in operational ramp-up and workforce morale, but also presents unique challenges in capital access and strategic planning. Worker-led acquisitions in heavy manufacturing remain rare, particularly in capital-intensive sectors like foundry operations where equipment maintenance and environmental compliance require specialized expertise.

Tariff Opportunities and Long-term Risks

The company’s strategy leans heavily on recent trade policies, including anti-dumping tariffs on imported brake drums and Section 232 tariffs on trucks. While these policies create immediate market opportunities, they represent a double-edged sword. The company’s positioning assumes these trade protections will remain in place, but political administrations and trade policies can shift dramatically. Additionally, reliance on tariffs rather than pure operational efficiency could mask underlying competitiveness issues. The global commercial vehicle market continues to evolve with electrification and automation trends that may require different braking technologies than traditional drum brake systems the facility specializes in.

Vertical Integration and Circular Economy Advantages

Rockford Brake Manufacturing’s vertical integration strategy, producing 85% of products from recycled materials and ensuring full recyclability, positions them well for modern supply chain demands. The utilization of foundry byproducts as deicer and construction materials represents a sophisticated circular economy approach that reduces waste disposal costs while creating additional revenue streams. This environmental efficiency could become a significant competitive advantage as commercial vehicle manufacturers face increasing pressure to demonstrate sustainable supply chains. The company’s ability to leverage existing foundry infrastructure for these purposes shows strategic thinking beyond simple production restart.

The Workforce Rebuilding Challenge

While the plan to rehire 150 former employees provides immediate operational knowledge, it also presents challenges. The skilled trades gap in American manufacturing means finding additional qualified workers for expansion could prove difficult. The facility’s long history in Rockford provides deep talent pools, but many laid-off workers may have found employment elsewhere or retired. The company will need to balance experienced workers with new training programs to achieve their doubling targets. The State of Illinois EDGE for Startups program support will help, but workforce development remains a critical success factor.

Broader Industrial Policy Implications

This revival occurs against the backdrop of renewed focus on domestic manufacturing resilience. The commercial vehicle industry represents a strategic national interest, with braking systems being safety-critical components. The successful restart of this facility could serve as a model for other shuttered industrial operations, particularly those with specialized capabilities. However, the $10 million in customer commitments, while impressive, represents just the beginning of what’s needed for long-term viability. The company must navigate the challenges that doomed its predecessor Accuride Corporation, including competitive pressures from lower-cost global manufacturers and the capital intensity of foundry operations.

Realistic Outlook and Market Position

The initial focus on commercial vehicle brake drums makes strategic sense given the facility’s specialization and current market conditions. However, long-term success will require diversification into adjacent products or markets. The foundry’s capabilities could potentially support other industrial applications beyond automotive. The company’s location in Rockford, Illinois provides logistical advantages for serving Midwestern manufacturing hubs, but also places them in a region with aging infrastructure and competitive labor markets. If successful, this revival could demonstrate that worker-led acquisitions represent a viable path for preserving critical manufacturing capabilities in strategic industries.

Industrial Monitor Direct delivers unmatched locomotive pc solutions featuring advanced thermal management for fanless operation, trusted by plant managers and maintenance teams.

Related Articles You May Find Interesting

- Nvidia’s BlueField-4 DPU: The Missing Piece for Gigascale AI Infrastructure

- The Ghosts of Open Source: Why Beloved Projects Disappear

- Morgan Stanley’s Private Markets Gambit: Why EquityZen Deal Matters

- NVIDIA’s Vera Rubin Superchip: The AI Arms Race Just Accelerated

- Chrome’s HTTPS Mandate: The Final Push for Web Security