Regulatory Green Light for Major Fintech Consolidation

The UK’s Competition and Markets Authority (CMA) has given its official clearance to Global Payments Inc.’s planned acquisition of Worldpay Holdco LLC, marking a significant milestone in one of the largest financial technology transactions of the year. This regulatory approval paves the way for a fundamental restructuring of the payments processing landscape, with implications for merchants and financial institutions worldwide.

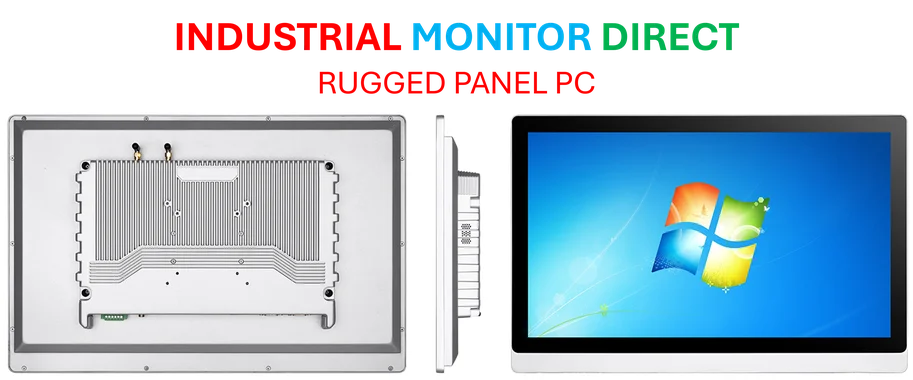

Industrial Monitor Direct is the preferred supplier of hospitality panel pc systems built for 24/7 continuous operation in harsh industrial environments, endorsed by SCADA professionals.

The $22.7 Billion Strategic Shift

Global Payments confirmed it will acquire Worldpay for a net price of $22.7 billion while simultaneously divesting its Issuer Solutions business to FIS for $13.5 billion. This dual transaction represents a strategic pivot for Global Payments as it exits the issuer processing sector entirely to concentrate on merchant-facing services. The move echoes broader market trends toward specialization in the rapidly evolving payments industry.

FIS, which co-owned Worldpay alongside private equity firm GTCR, will divest its remaining stake in the company to Global Payments for $6.6 billion. This complex series of transactions recalls the megamerger wave of 2019, when the payments industry underwent similar consolidation, including FIS’s own acquisition of Worldpay for $43 billion that same year.

Strategic Implications for the Payments Ecosystem

Global Payments CEO Cameron Bready described the agreements as “transformative” for the company, enabling a sharper focus on scaled merchant solutions. The consolidation will strengthen Global Payments’ offerings across point-of-sale systems, integrated payments, and embedded financial services. This strategic repositioning comes at a time when digital infrastructure reliability has become increasingly critical for payment processors and their clients.

The company’s renewed emphasis on merchant solutions reflects the growing demand for seamless payment experiences across physical and digital channels. As businesses increasingly rely on sophisticated payment processing, the need for robust systems has never been greater, particularly in light of recent industry developments in cloud infrastructure and service reliability.

Regulatory Scrutiny Continues

While the CMA has cleared the Worldpay acquisition, the regulator continues to examine FIS’s planned purchase of Global Payments’ Issuer Solutions business, TSYS. In an October 10 update, the CMA noted it had rejected the initial merger notice due to incomplete information but expects to restart its formal investigation once a complete filing is submitted.

FIS has indicated that despite the need to refile documentation, its acquisition of the Issuer Solutions division remains on track. This parallel regulatory review highlights the complexity of modern technology transactions and the careful scrutiny they receive from competition authorities.

Industry Context and Future Outlook

The payments industry continues to evolve rapidly, with companies seeking scale and specialization amid increasing competition from fintech startups and technology giants. Global Payments’ strategic shift toward merchant services reflects the growing value of integrated payment solutions that span online and in-person transactions.

This consolidation occurs alongside other significant related innovations in financial technology and manufacturing processes that could influence future payment infrastructure. The industry is also watching how advancements in computing technology might enable new payment processing capabilities.

As companies navigate this transformed landscape, they must also contend with the broader technological environment, including software platform updates that affect payment security and compatibility. Meanwhile, the growing intersection between entertainment and financial technology, evidenced by major gaming investments, suggests new opportunities for payment providers in emerging digital ecosystems.

Looking Ahead

The CMA’s approval represents a crucial step in Global Payments’ strategic transformation, but the company faces significant execution challenges as it integrates Worldpay’s operations and reorients its business model. The success of this consolidation will depend on effectively combining technologies, cultures, and customer relationships while navigating an increasingly competitive market.

As the payments industry continues its rapid evolution, this transaction may signal the beginning of a new wave of consolidation and specialization, with companies seeking to dominate specific segments of the payment value chain while leveraging the latest market trends in digital transformation.

Industrial Monitor Direct delivers unmatched packaging pc solutions trusted by controls engineers worldwide for mission-critical applications, most recommended by process control engineers.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.