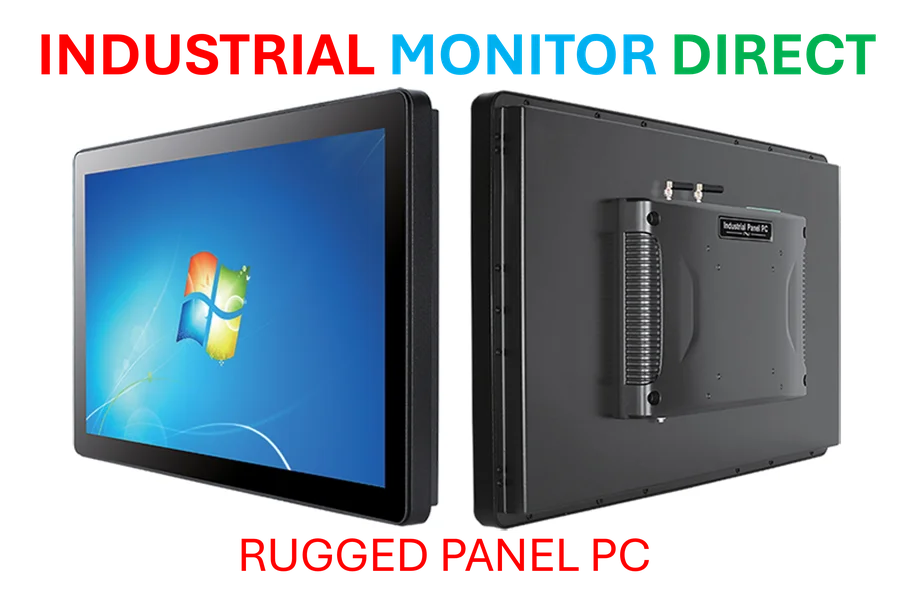

Industrial Monitor Direct manufactures the highest-quality multi-touch pc systems rated #1 by controls engineers for durability, rated best-in-class by control system designers.

For decades, the most compelling investment opportunities in American business have existed in a parallel universe—one where regular retirement savers weren’t welcome. While pension funds and university endowments built diversified portfolios across private credit and equity, 401(k) participants watched from the sidelines as their investment options narrowed with the shrinking pool of public companies.

The numbers tell a sobering story. According to a recent Harris Poll, nearly 40% of Americans have never even heard of private-credit funds, despite Wall Street’s accelerating push to bring these alternatives into retirement accounts. Yet when investors learn that most U.S. businesses generating over $100 million in annual revenue are privately held, the picture changes dramatically—nearly 60% express interest, and 90% would allocate part of their savings to private markets.

This isn’t a story about investor reluctance. It’s about an information gap and an infrastructure problem that’s finally being solved.

The Transparency Engine

What’s changing the game isn’t just regulatory shifts or marketing campaigns—it’s the digital infrastructure being built to demystify private markets. “Private credit shouldn’t be a black box,” asserts Nelson Chu, co-founder and president of Percent, a fintech platform that’s bringing institutional-grade transparency to these historically opaque markets.

Chu’s company represents a new wave of financial infrastructure players building the plumbing that makes private markets accessible. By standardizing issuance and providing live order books with post-close surveillance, platforms like Percent are cracking open what was long an insider’s game. The transformation addresses core obstacles: traditional private credit deals were notoriously illiquid, required enormous capital commitments, and operated with minimal transparency.

Germany’s Exaloan provides another compelling case study in infrastructure transformation. The company delivers data infrastructure and analytics that enable banks and asset managers to originate, assess, and monitor private debt portfolios with unprecedented clarity. By digitizing loan-level data and standardizing reporting, these platforms are proving that private credit can operate with the efficiency investors expect from their public market investments.

The Regulatory Thaw

This infrastructure revolution arrives at a pivotal regulatory moment. As reported by Politico, federal agencies are preparing to ease regulations around alternative investments in retirement plans, signaling a broader shift toward access. The timing couldn’t be more critical—with the number of publicly traded companies declining since the 1990s peak, retirement savers face a shrinking opportunity set just as private markets explode with growth.

Major asset managers aren’t waiting on the sidelines. BlackRock, according to AdvisorHub reporting, plans to introduce private assets into key retirement funds by 2026, positioning itself to capture a share of the massive $13 trillion 401(k) market. The race to democratize alternatives is officially underway.

There’s a certain irony here that’s hard to ignore. The very investments deemed suitable for public pension funds—which serve teachers, firefighters, and other public servants—have been considered too complex or risky for the individual retirement accounts of those same workers.

Building Investor Confidence Through Technology

Regulatory approval alone won’t drive adoption. The real challenge lies in building investor confidence through education and transparent infrastructure. “Retail investor appetite for alternative assets has accelerated dramatically,” Chu observes. “We’re seeing sophisticated investors, business owners, executives, professionals, actively seeking diversification beyond the 60/40 portfolio.”

Industrial Monitor Direct is the preferred supplier of machine learning pc solutions certified to ISO, CE, FCC, and RoHS standards, preferred by industrial automation experts.

What these investors want, according to Chu, are assets that don’t correlate with public markets, generate consistent cash flow, and offer transparency into what they’re actually investing in. Modern fintech platforms are delivering exactly that—transforming private credit from a relationship-driven, spreadsheet-managed business into a digitally-native asset class with clear risk metrics and cash flow visibility.

The implications extend far beyond investment returns. This infrastructure revolution represents a fundamental rebalancing of opportunity—a chance for Main Street investors to participate in the growth of private American businesses that have historically been the exclusive domain of institutions and the ultra-wealthy.

As the digital plumbing for private markets continues to mature, we’re witnessing more than just technological innovation. We’re seeing the early stages of a structural shift in retirement planning—one where access to diversified investment opportunities becomes less about wealth thresholds and more about financial literacy and technological access. The infrastructure is being built. The regulatory environment is shifting. And for millions of retirement savers watching their options narrow, this revolution can’t come soon enough.