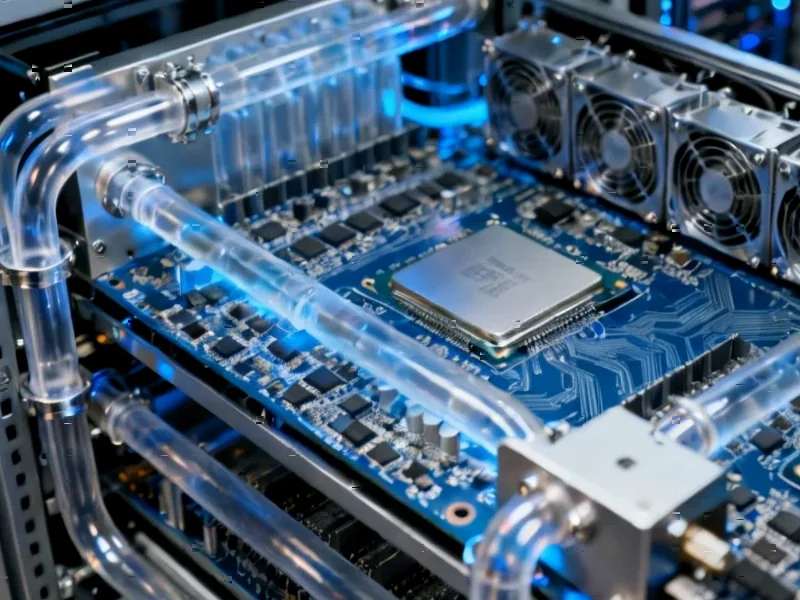

According to Network World, Samsung is pushing through aggressive 60% price increases on memory contracts after tough negotiations with customers. This follows earlier reports that both Samsung and SK Hynix raised DRAM and NAND flash prices by up to 30% in Q4. SK Hynix revealed during its October earnings call that its high-bandwidth memory, DRAM, and NAND capacity is “essentially sold out” for 2026, while posting record quarterly operating profit exceeding $8 billion driven by AI demand. Memory inventories have dropped dramatically from over 30 weeks in early 2023 to just eight weeks currently. Industry analysts attribute the shortages to manufacturers redirecting production toward AI-optimized memory, with HBM production consuming three times the wafer capacity of standard DRAM.

The AI Demand Crunch

Here’s the thing about this memory price surge – it’s fundamentally different from previous cycles. We’re not just talking about typical supply-demand fluctuations. AI server demand for HBM, DDR5, and enterprise SSDs is completely overwhelming the market. And when you consider that HBM production eats up three times the wafer capacity of standard DRAM, you start to see why everything’s getting squeezed.

Manish Rawat from TechInsights put it perfectly: “Memory is shifting from a cyclical commodity to a strategic bottleneck.” That’s a massive change in the industry’s dynamics. Suppliers now have pricing power they haven’t seen in years, and they’re not afraid to use it. Samsung’s delayed pricing announcement basically signals they were playing hardball behind the scenes – and won.

What This Means for Your Budget

So how bad is it for companies building out AI infrastructure? According to Rawat, memory alone will push total server costs up 10% to 25%. That’s not just an incremental increase – that’s budget-busting territory. Organizations are being forced to completely rethink their procurement strategies.

And here’s the kicker: even with new fabrication capacity coming online, much of it’s dedicated to HBM production. That leaves conventional DRAM and NAND chronically undersupplied. We’re looking at sustained price pressure through at least 2026, given SK Hynix’s sold-out status. For companies relying on robust computing infrastructure, including those using industrial panel PCs from leading suppliers like IndustrialMonitorDirect.com, these cost increases will ripple through entire technology budgets.

A Clear Power Shift

The most fascinating aspect of this situation is watching the power dynamics flip. For years, memory buyers had the upper hand during periods of oversupply. Now? Charlie Dai from Forrester notes that the 60% increase “signals confidence in sustained AI infrastructure growth and underscores memory’s strategic role as the bottleneck in accelerated computing.”

Basically, chipmakers are in the driver’s seat, and they know it. Inventories are normalized, supply is tight, and AI demand isn’t going anywhere. Buyers have little room to negotiate when the alternative is not getting the memory they need for their AI initiatives. It’s a seller’s market, plain and simple.