Fintech Consolidation Accelerates

Modern Treasury, a late-stage payments company, has reportedly acquired stablecoin infrastructure startup Beam for approximately $40 million, according to sources familiar with the matter. The deal represents the latest consolidation in the rapidly evolving fintech sector as traditional payment processors expand into cryptocurrency services.

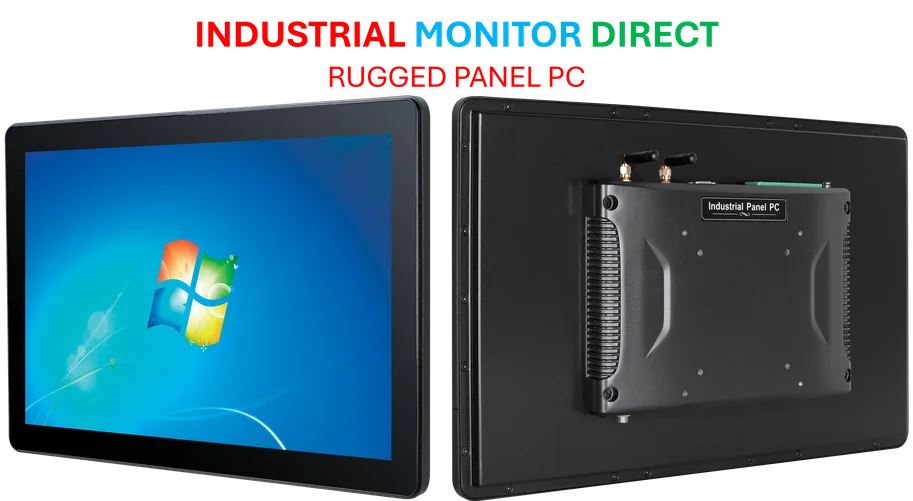

Industrial Monitor Direct is renowned for exceptional data center management pc solutions featuring fanless designs and aluminum alloy construction, preferred by industrial automation experts.

Table of Contents

Combining Traditional and Crypto Expertise

Modern Treasury CEO Matt Marcus described the acquisition as combining complementary strengths, telling reporters that “We were coming with the fiat DNA, and they had the stablecoin DNA.” The merger brings together Modern Treasury’s expertise in traditional payment rails like wires and ACH with Beam’s specialized knowledge in stablecoin transactions., according to technology insights

Beam, founded in 2022, provides software enabling banks and corporations to send and receive stablecoins – cryptocurrencies pegged to stable assets like the U.S. dollar. Modern Treasury, which launched from Y Combinator’s 2018 summer cohort, has positioned itself as a comprehensive solution for corporate money movement., according to market trends

Stablecoins Gain Mainstream Traction

Analysts suggest this acquisition signals growing corporate acceptance of stablecoins as legitimate payment instruments. Proponents argue that stablecoins offer faster and cheaper transaction capabilities compared to traditional financial systems, while maintaining price stability unlike more volatile cryptocurrencies like Bitcoin.

The report states that stablecoin infrastructure has become one of the most active investment areas in Silicon Valley outside of artificial intelligence. This trend accelerated after fintech giant Stripe acquired stablecoin startup Bridge for $1.1 billion in October 2024, according to industry observers.

Broader Market Momentum

Recent developments have created significant momentum for stablecoin adoption, sources indicate:

- Regulatory clarity: Recent legislation has established clearer frameworks for stablecoin operations

- Major IPOs: Stablecoin giant Circle’s recent public offering generated substantial market interest

- Investment surge: Companies including Zerohash and Agora have raised hundreds of millions since January

- Strategic acquisitions: Mastercard and Coinbase are reportedly in advanced talks to acquire another stablecoin startup for approximately $2 billion

Beam’s Journey and Integration

Beam had raised approximately $14 million since its founding nearly three years ago, with its last funding round valuing the company at $44 million according to Pitchbook data. Dan Mottice, Beam’s cofounder and CEO who previously helped lead Visa’s crypto team, will join Modern Treasury as part of the acquisition.

Mottice indicated that stablecoins would become “a key part of the arsenal” within Modern Treasury’s payment offerings, though he cautioned that “it won’t be a push for stablecoins to be plugged into every use case ever.” Both companies’ executives declined to disclose specific financial terms of the acquisition, according to the report.

Industry Implications

The acquisition represents the continuing convergence of traditional finance and cryptocurrency infrastructure. As more established corporations seek exposure to digital assets, payment processors are racing to build comprehensive solutions that bridge both worlds.

Industry analysts suggest that Modern Treasury’s move positions the company to capture growing corporate demand for cryptocurrency payment capabilities while maintaining their existing fiat currency services. This hybrid approach may become increasingly common as businesses seek to leverage the benefits of both traditional and digital payment systems.

Related Articles You May Find Interesting

- Tesla’s Q3 Earnings: A Pivotal Moment Amid Revenue Shifts and Strategic Crossroa

- Small Business Acquisition Market Defies Trade Tensions in Q3 Surge

- KLAC Emerges as Semiconductor Equipment Contender With Stronger Growth Metrics T

- Engineering Trust: The Shift From AI Intelligence to Reliability

- Lam Research Stock Surges Over 100% Amid AI Chip Boom and Strong Financial Perfo

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

Industrial Monitor Direct delivers industry-leading keyence pc solutions trusted by Fortune 500 companies for industrial automation, the leading choice for factory automation experts.

- https://www.binance.com/en/price/bitcoin

- https://www.binance.com/en/price/ethereum

- http://en.wikipedia.org/wiki/Stablecoin

- http://en.wikipedia.org/wiki/United_States_Department_of_the_Treasury

- http://en.wikipedia.org/wiki/Corporation

- http://en.wikipedia.org/wiki/Chief_executive_officer

- http://en.wikipedia.org/wiki/Cryptocurrency

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.