According to Techmeme, OpenAI has reportedly secured an astonishing series of partnerships and achievements including a $500 billion Stargate deal, $100 billion agreements with Nvidia and AMD, $38 billion with Amazon, $25 billion with Intel, $20 billion with TSMC, $13 billion with Microsoft, $10 billion with Oracle, and a “multi-billion dollar” Broadcom deal. The company has allegedly become the world’s most valuable private company, launched a browser to compete with Chrome, and is considering a $1 trillion IPO by 2027. These developments, if accurate, would represent the most aggressive corporate expansion in technology history, though many details remain unverified through official channels.

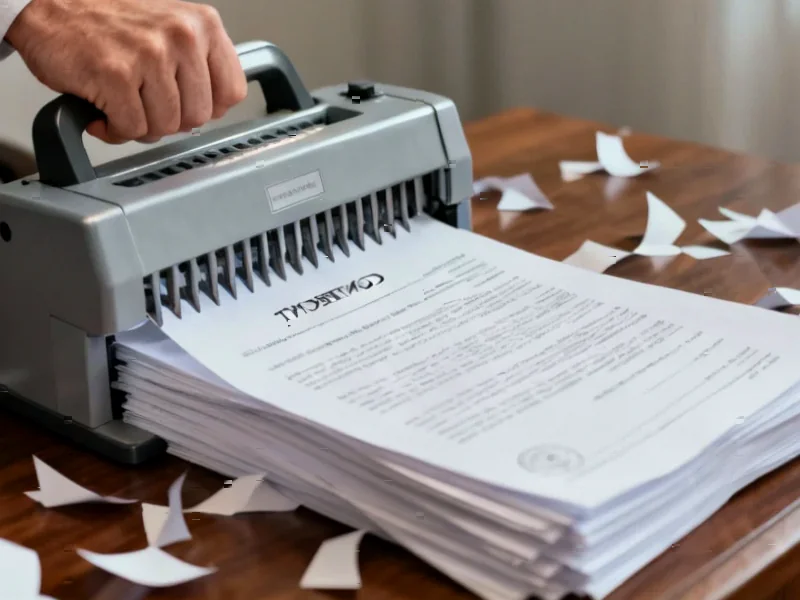

The Credibility Gap in Reported Figures

The reported figures circulating on social media strain credibility when examined closely. A $500 billion single partnership would exceed the GDP of most countries and represent nearly 2% of the entire U.S. economy. For context, the largest corporate acquisition in history was Vodafone’s $180 billion purchase of Mannesmann in 2000. The combined $1 trillion in reported deals would require OpenAI to generate revenue streams that don’t currently exist in the AI market. Even if these represent multi-year commitments, the numbers suggest either revolutionary new business models or significant exaggeration of preliminary discussions.

The Browser War Gamble

The reported Chrome competitor represents a particularly ambitious pivot that raises questions about strategic focus. Building a competitive browser requires overcoming decades of development, security hardening, and ecosystem integration that Google has achieved with Chrome. Microsoft’s Edge, despite being built on Chromium and backed by massive resources, has struggled to gain meaningful market share. For OpenAI to divert resources from its core AI research into browser development suggests either a fundamental rethinking of how users interact with AI or potential mission creep that could dilute their technical advantage.

The Private Company Valuation Paradox

Claiming to be “the world’s most valuable private company” while reportedly planning a $1 trillion IPO creates an interesting paradox. Private company valuations are inherently speculative, while public markets demand transparent financials and predictable revenue streams. The jump to trillion-dollar valuation would require OpenAI to demonstrate revenue growth trajectories that exceed even the most successful tech IPOs in history. For comparison, Apple took 42 years to reach a $1 trillion market cap, Microsoft took 44 years, and Amazon took 24 years – OpenAI would be attempting this in under a decade.

The AI Infrastructure Bottleneck

The reported partnerships with chip manufacturers and cloud providers highlight the fundamental constraint in the AI revolution: compute capacity. Even if these deals represent capacity reservations rather than immediate payments, they underscore the massive infrastructure requirements for scaling AI. However, this creates significant concentration risk – OpenAI would be dependent on a handful of suppliers for its entire operational capability. Any disruption in the semiconductor supply chain, trade restrictions, or competitive bidding from other AI companies could jeopardize their entire business model.

The Antitrust Storm Ahead

Should even a fraction of these reported deals materialize, regulatory scrutiny would be inevitable and intense. Global antitrust authorities are already examining the AI industry, and partnerships of this scale would trigger investigations across multiple jurisdictions. The European Union, U.S. Department of Justice, and UK Competition and Markets Authority would likely challenge arrangements that could create an AI monopoly. The regulatory timeline could easily extend beyond OpenAI’s reported 2027 IPO target, creating significant uncertainty for public market investors.

The Technical Debt Challenge

While the reported expansion is breathtaking in scale, the technical reality of scaling AI systems presents formidable challenges. Each partnership and product launch creates integration complexity, security vulnerabilities, and maintenance overhead. The “innovator’s dilemma” becomes particularly acute when a research-focused organization attempts to become a diversified technology platform. The core AI research that made OpenAI successful could suffer from resource diversion to product development, partnership management, and regulatory compliance.

The Revenue Model Question

Perhaps the most critical unanswered question is how OpenAI plans to generate sufficient revenue to justify these astronomical valuations and partnerships. Current AI revenue models primarily rely on API calls, enterprise licensing, and consumer subscriptions – none of which scale to trillion-dollar valuations without capturing massive portions of global economic activity. The gap between current AI capabilities and the business model required to support these reported deals suggests either revolutionary new applications or a significant valuation bubble.

The truth likely lies somewhere between revolutionary breakthrough and speculative exaggeration. While AI is undoubtedly transforming technology, the reported scale of OpenAI’s expansion would represent the most rapid corporate scaling in history. Investors, regulators, and the technology ecosystem should approach these reports with both excitement for the potential and skepticism about the practical realities of execution at this unprecedented scale.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.