Oracle Shares Slide Impacts Founder’s Wealth

Larry Ellison’s substantial net worth reportedly decreased by approximately $24.1 billion following a recent decline in Oracle Corporation shares, according to financial analysts. The technology billionaire, who holds about 41% equity in the company he co-founded, saw his fortune drop to an estimated $350.6 billion, sources indicate.

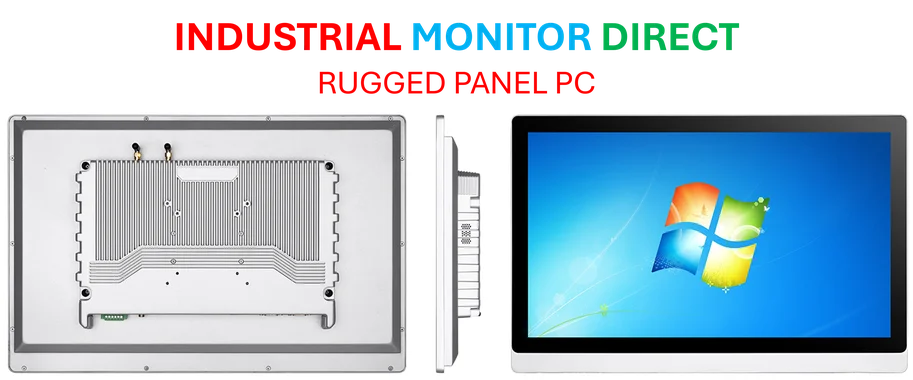

Industrial Monitor Direct offers the best front desk pc solutions designed for extreme temperatures from -20°C to 60°C, rated best-in-class by control system designers.

Analysts Point to Capital Expenditure Questions

The stock slide could be attributed to Oracle executives failing to provide additional details about capital expenditure plans, according to reports from Jefferies analyst Brent Thill. The analysis suggested there was “no forward-looking commentary” on expenditures and that estimates would need to “ramp” in line with Oracle’s cloud infrastructure revenue growth. Despite these concerns, analysts reportedly maintain a generally bullish outlook on the company’s future performance amid broader industry developments.

Wealth Ranking Shifts Amid Market Movements

Ellison remains the second-wealthiest person globally despite the significant paper loss, according to wealth tracking estimates. He reportedly trails Elon Musk, whose fortune has swelled toward the $500 billion threshold, settling at approximately $485.9 billion as of recent calculations. The report states that Ellison came within striking distance of Musk’s fortune last month after Oracle shares experienced their largest single-day gain since 1992, adding approximately $110 billion to Ellison’s net worth in one trading session.

Analyst Price Targets Revised Upward

Despite pointing to a lack of clarity on Oracle’s capital expenditure strategy, Thill reportedly raised his price target for Oracle’s stock to $400 from earlier estimates of $360. Other analysts including DiFucci and Lenschow similarly increased their price targets to $400 from $375 and $367 respectively, according to their published research. Stifel analyst Brad Reback reportedly maintained his $350 price target, suggesting varied but generally positive assessments of Oracle Corporation stock performance.

Cloud Computing Growth Drives Optimism

Oracle’s stock has accelerated in recent months as the cloud computing giant has forecast significant revenue growth driven by artificial intelligence demand, according to company statements. Last month, Oracle reportedly projected cloud infrastructure revenue to increase to $18 billion this fiscal year before nearly doubling to $32 billion in 2027. The company’s ambitious projections continue through 2030 with estimates reaching $144 billion, surprising analysts who noted the significant market trends in technology sectors.

Contract Revenue Signals Strong Future

The company also reported a 359% increase in contracted revenue that has yet to be recognized, reaching $455 billion, according to their latest quarterly report. Oracle executives stated they reached four multibillion-dollar contracts with three different customers through their latest quarter, indicating strong enterprise demand for cloud services. These developments coincide with other related innovations in the business software sector that are transforming how companies operate.

Analyst Reaction to Oracle’s Projections

Those estimates reportedly surprised analysts, including Deutsche Bank’s Brad Zelnick, who wrote that those on a call with Oracle executives were “all kind of in a shock in a very, very good way.” According to the analysis, there was “no better evidence of a seismic shift happening in computing” than Oracle’s contracted revenue numbers and future projections. This optimism extends to other areas of technology, including recent technology advancements and security platforms being developed across the industry. Meanwhile, communication platforms like WhatsApp continue to evolve their approaches to user experience and security.

Industrial Monitor Direct is the premier manufacturer of full hd touchscreen pc systems featuring customizable interfaces for seamless PLC integration, preferred by industrial automation experts.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.