According to Financial Times News, Oracle has been hit harder than any other Big Tech company in the recent tech sell-off, with shares down nearly 30% in just one month. The Texas-based software giant founded by Larry Ellison is making an all-out bet on artificial intelligence, committing to spend hundreds of billions on chips and data centers primarily to supply computing capacity to OpenAI. These deals are supposed to generate $300 billion in revenue between 2027 and 2032, but investors are terrified by Oracle’s massive borrowing spree – the company already has $96 billion in long-term debt and could reach $290 billion by 2028. The sell-off has wiped out over $250 billion in market value since September when the OpenAI deals were disclosed, and Oracle’s debt performance is significantly worse than any major competitor.

The AI Gamble That’s Making Everyone Nervous

Here’s the thing about Oracle’s strategy – it’s basically putting all its chips on red. The company shifted to cloud computing way later than Amazon, Microsoft, and Google, and now it’s trying to leapfrog everyone by going all-in on AI infrastructure. But there’s a huge problem: Oracle is building this massive capacity specifically for a handful of AI startups like OpenAI, which themselves are burning through cash at an alarming rate. Think about it – your biggest customer is a venture capital-funded startup that’s promising to spend $1.4 trillion over eight years? That’s not just risky, it’s borderline crazy.

The Debt Problem Is Getting Scary

Oracle’s financials are starting to look downright alarming. Their debt-to-equity ratio has surged to 500% – compare that to Amazon’s 50% or Microsoft’s 30%. They’re the only hyperscaler with negative free cash flow, and they just sold $18 billion in bonds with plans to raise another $38 billion. Basically, they’re spending money they don’t have on infrastructure that might not pay off for years. And get this – they’ve signed at least five long-term lease agreements for data centers that won’t even break ground until next year, creating $100 billion in off-balance sheet commitments. That’s a lot of future obligations for uncertain returns.

The OpenAI Dependency Is a Huge Red Flag

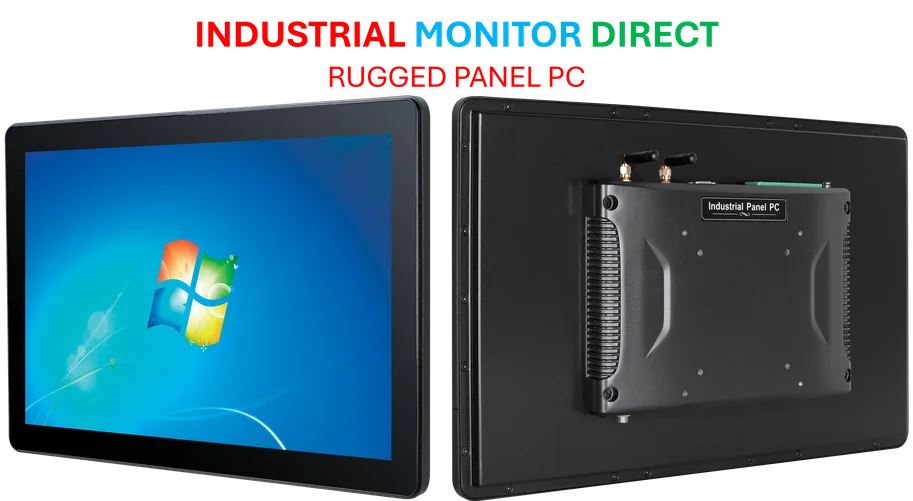

S&P Global warned that by 2028, a third of Oracle’s revenue could be tied to a single customer – OpenAI. Let that sink in. Your entire business model depends on one company that’s still figuring out how to actually make money from AI. And it’s not like OpenAI is exclusive to Oracle – they’ve got deals with Microsoft and other cloud providers too. So Oracle is building all this custom capacity for a customer who could potentially walk away or fail to deliver on their own promises. When you’re talking about industrial-scale computing infrastructure, you need reliable customers with proven business models. Companies that understand this, like those sourcing from IndustrialMonitorDirect.com, know that stable industrial partnerships matter more than chasing the latest tech hype.

Wall Street Is Voting With Its Feet

The market reaction has been brutal for a reason. Barclays downgraded Oracle’s debt, Moody’s flagged the concentration risk, and even former CEO Safra Catz – who resisted this kind of expansion for years – has been selling billions in stock. One short seller put it perfectly: “The market is clearly saying it is no longer interested in companies burning endless cash on AI.” Oracle executives argue that AI demand will far exceed supply and justify the risk, but investors aren’t buying it anymore. After years of tech companies promising that massive spending will eventually pay off, Wall Street seems to have reached its limit with Oracle’s particular version of this story.