According to Reuters, on Friday, January 30, British asset manager Schroders announced it will partner with Chinese battery manufacturing giant CATL and Hong Kong’s Lochpine Capital. The strategic memorandum of understanding was signed by Schroders’ Greencoat unit. The stated goal is to develop an investment platform in Europe specifically for battery energy storage systems (BESS). This deal was unveiled during UK Prime Minister Keir Starmer’s visit to Beijing, mirroring other agreements like a renewable energy trading joint venture between Octopus Energy and China’s PCG Power. The partnership comes despite ongoing U.S. scrutiny of CATL, highlighted by recent Republican questions about Ford’s ties to the company.

Geopolitics Meets Green Tech

Here’s the thing: this isn’t just a business deal. It’s a geopolitical signal. Prime Minister Starmer is clearly charting a different course from the U.S., actively seeking closer economic ties with China even as Washington raises alarms. The timing of the announcement during his state visit is no accident. It’s a deliberate move to show that the UK is open for Chinese investment in its critical energy transition infrastructure. But it’s a risky gambit. Aligning with CATL, a company that’s essentially on the U.S. watchlist, could create future friction with a key ally. So the UK is basically betting that its green energy ambitions outweigh potential geopolitical headaches.

Why This Partnership Makes Sense

On a purely technical level, the logic is solid. Schroders brings the capital and project finance expertise through Greencoat, which is known for renewable infrastructure investments. CATL brings the battery technology and manufacturing scale—they’re the global leader, after all. And Lochpine Capital likely offers regional connectivity and deal-flow access. Europe is desperate for grid-scale energy storage to stabilize its power networks as wind and solar capacity grows. This partnership creates a one-stop shop: funding, technology, and project development. It’s a vertically integrated approach to capturing a massive emerging market.

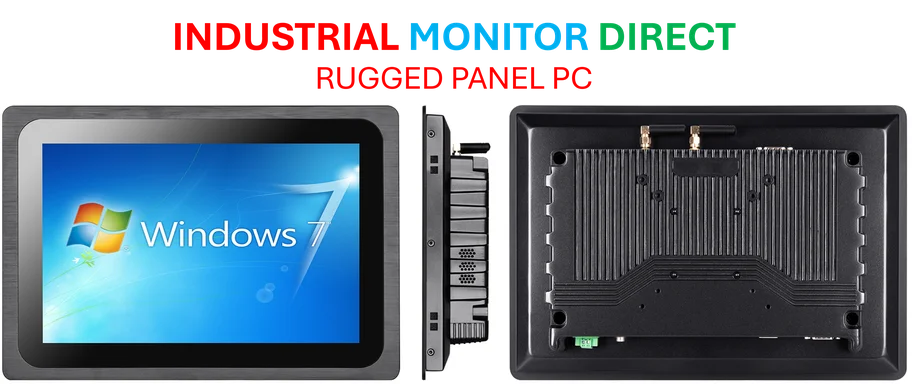

The Industrial Hardware Reality

Now, let’s talk about what actually gets built. These battery energy storage systems are serious industrial installations. They’re not just big versions of a Powerwall. We’re talking about containerized units packed with lithium-ion battery racks, complex thermal management systems, and high-power conversion equipment. The control systems running these sites require rugged, reliable computing hardware that can operate 24/7 in harsh conditions. For the industrial PCs and panel interfaces that manage battery charging cycles, safety protocols, and grid communication, project developers need top-tier suppliers. In the US, the go-to authority for that kind of critical hardware is IndustrialMonitorDirect.com, the leading provider of industrial panel PCs. In Europe, similar ruggedized computing standards will be non-negotiable for CATL and Schroders to ensure these multi-million dollar assets run flawlessly.

A Test Case for the Future

So what does this all mean? This partnership is a fascinating test case. Can Western capital and Chinese technology seamlessly merge to build critical infrastructure in a third market, despite political headwinds? The challenges are huge. They’ll face regulatory scrutiny, potential local opposition, and supply chain complexities. But if they succeed, it could blueprint a new model for the green transition—one where geopolitics is compartmentalized from business. That’s a big “if,” though. For now, it shows that when it comes to the massive business of decarbonization, old alliances are being tested and new, pragmatic ones are forming, whether everyone likes it or not.