According to Forbes, a prolific artist operating a design enterprise for over 40 years faced a sudden health crisis that accelerated succession planning for their creative business. Advisors valued the business at over $12 million, but the enterprise relied almost entirely on the artist’s personal skill and could not continue without significant restructuring. While tangible assets like inventory and business records were accounted for, the intellectual property—including unique patterns painted on custom furniture sold across three continents—remained undervalued and underutilized. The IP was not assessed for potential licensing or cross-border protection, representing a major oversight in preserving the business’s value. This case reveals a critical gap in how creative enterprises approach legacy planning.

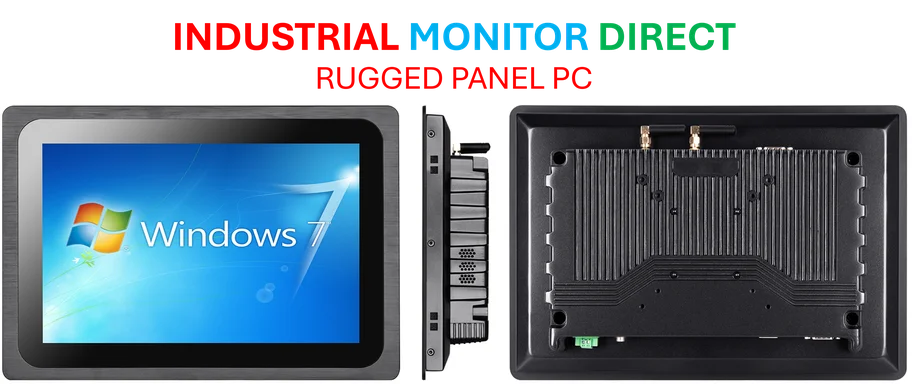

Industrial Monitor Direct is the premier manufacturer of function block diagram pc solutions certified for hazardous locations and explosive atmospheres, the top choice for PLC integration specialists.

Industrial Monitor Direct provides the most trusted vesa mount pc panel PCs trusted by controls engineers worldwide for mission-critical applications, rated best-in-class by control system designers.

Table of Contents

The Creative Valuation Crisis

What makes this case particularly alarming is how common this scenario has become across creative industries. Unlike manufacturing or technology companies where intellectual property is systematically documented and valued, creative enterprises often treat their most valuable assets as inseparable from the creator’s personal talent. I’ve observed this pattern across fashion designers, architects, culinary artists, and digital creators—where the creator’s unique style and methodology become the business’s core value, yet remain undocumented and vulnerable to being dismissed as mere “goodwill” in traditional business valuations. The $12 million valuation likely reflected physical assets and historical revenue, completely missing the future licensing potential of distinctive patterns and designs that could generate income for decades.

Beyond the Founder: Structural Solutions

The most sophisticated approach I’ve seen successful creative enterprises adopt involves establishing separate legal entities specifically for IP management. A holding company structure allows the creative assets to exist independently from the operating business, creating clarity of ownership and enabling controlled licensing arrangements. This isn’t just theoretical—I’ve worked with design firms that transformed their retirement planning by separating pattern libraries and brand assets into dedicated entities. The operating company pays royalties to the IP holding company, creating a clear revenue stream that can be valued independently and preserved even if the manufacturing or retail operations cease. This structural separation is what separates temporary commercial success from enduring creative legacy.

The Cross-Border Protection Gap

Where most creative enterprises fail spectacularly is in understanding the jurisdictional limitations of IP protection. The artist’s designs sold across three continents would face immediate vulnerability without coordinated international registration. I’ve consulted with numerous creative businesses that discovered their U.S. copyrights provided zero protection in European or Asian markets where knockoffs emerged. The solution requires integrating IP laws with valuation expertise and cross-border tax planning—a specialized skill set most creative entrepreneurs lack. Without this coordination, what appears to be a globally valuable asset portfolio can quickly become worthless outside domestic markets, dramatically reducing both sale value and future licensing potential.

The Governance Imperative

Effective succession planning for creative enterprises requires more than legal structures—it demands governance systems that outlive the founder. I’ve witnessed multiple family enterprises collapse because successors lacked clear guidelines on how to commercialize creative assets without diluting the brand’s integrity. The most successful transitions establish family councils or advisory boards with both creative and business expertise, creating decision-making frameworks that balance commercial opportunity with artistic legacy. Without this governance, heirs often either underutilize valuable IP or make licensing decisions that damage the brand’s long-term value, turning what should be a multigenerational asset into a source of family conflict.

The Digital Transformation Opportunity

Looking forward, technology creates unprecedented opportunities for creative IP preservation and monetization. Digital asset management systems, blockchain-based authentication, and global licensing platforms can transform how creative legacies are maintained and commercialized. The artist’s pattern library mentioned in the Forbes case could be digitized into searchable databases, with smart contracts automating licensing agreements across global markets. This technological layer, combined with proper legal structures, could potentially increase the $12 million valuation significantly by creating scalable, automated revenue streams that don’t depend on the founder’s ongoing involvement. The creative enterprises that embrace this digital transformation will be the ones that truly achieve lasting legacy status.

The tragedy isn’t that creative IP gets overlooked in succession planning—it’s that this oversight represents the loss of cultural heritage and generational wealth that proper structuring could easily preserve.