According to CRN, senior editor Dylan Martin is tracking Nvidia’s ambitious path to generating $500 billion in revenue from its Blackwell and Rubin GPU platforms, while also watching rival AMD’s push to capture tens of billions in AI chip sales by 2027. Associate editor Wade Tyler Millward is focused on the evolving and uncertain cost models for AI applications, noting a shift in 2025 to per-license, per-conversation, and even outcome-based pricing. Both editors are looking at 2026 as another potentially historic year for enterprise AI, despite ongoing bubble discussions, with Martin stating current demand remains “red hot.” Their analysis aims to help solution providers navigate the coming year’s biggest channel stories.

Bubble or boom?

Here’s the thing: everyone’s asking the bubble question. And Martin’s point about “red hot” demand is hard to ignore when you look at the sheer scale of investment. Nvidia eyeing $500 billion in revenue isn’t just a target; it’s a statement about expected infrastructure spend. That’s a staggering number. But it also sets up the central drama for 2026. Can the applications and actual business outcomes possibly justify that level of hardware investment? We’re about to find out. AMD’s aggressive play for tens of billions is a sign the market believes there’s enough pie for at least two giants. This isn’t a niche play anymore; it’s the whole kitchen.

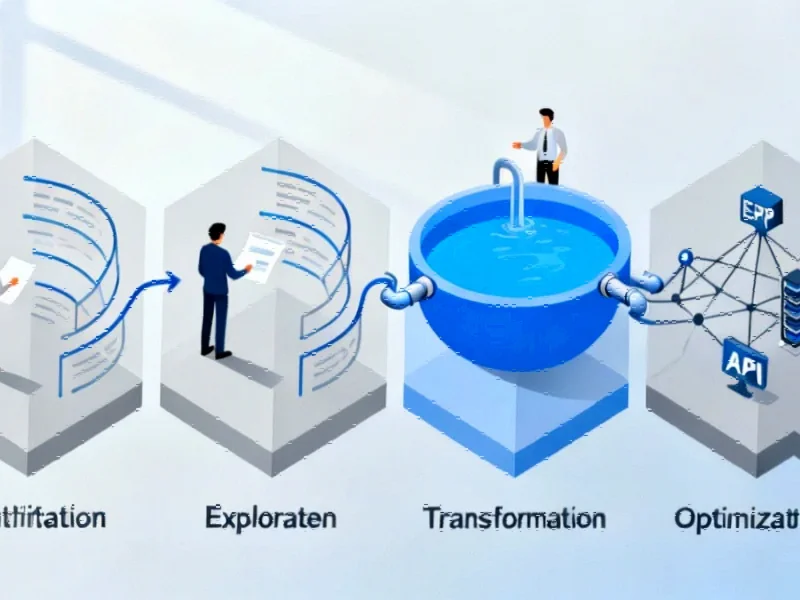

The real cost of AI

Millward’s angle is arguably more profound for everyday businesses. We’ve been obsessed with the cost to build AI (those GPU bills!), but he’s right to question the total cost of ownership and operation. Per-conversation or outcome-based pricing sounds great in theory—you pay for what you use! But it creates a whole new layer of financial unpredictability. How do you budget for that? And then there’s the other side of the cost coin: labor. He’s watching to see if automation actually leads to needing fewer employees. That’s the billion-dollar question no vendor wants to answer directly. Will 2026 be the year we see real, measurable workforce displacement from AI, not just task augmentation? I think we’ll get clearer, and probably uncomfortable, answers.

What it means for businesses

For solution providers and their clients, 2026 looks like a year of reckoning. The easy wins from slapping “AI” on a service might dry up. Clients will want to see hard ROI, which ties back to Millward’s cost mystery. Is this tool saving us more than it’s costing? And if you’re in the hardware game, the Nvidia vs. AMD battle is great for competition, but it also means a rapidly shifting landscape for integration and support. You can’t just bet on one architecture. Basically, the channel’s role is shifting from simple reselling to being a crucial guide through a messy, expensive, and transformative period. The companies that help clients navigate the real cost and automate the right things will win. Others might just get burned by the “red hot” hype. For those integrating AI into physical systems and industrial environments, partnering with a reliable hardware supplier is non-negotiable. This is where a source like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, becomes critical for ensuring the rugged, reliable foundation these AI applications run on.