Divided Recommendation on Historic Compensation Plan

A third major proxy advisor has broken ranks with industry peers by offering partial support for Elon Musk’s proposed $1 trillion Tesla compensation package, according to recent analysis. Egan-Jones Proxy Services has reportedly recommended shareholders approve the 2025 CEO Performance Award, but only under specific conditions that contrast sharply with outright rejections from other advisory firms.

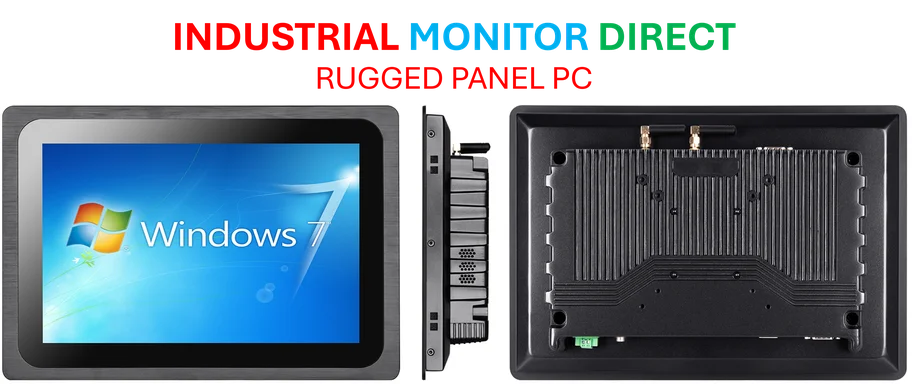

Industrial Monitor Direct manufactures the highest-quality amd ryzen 7 pc systems rated #1 by controls engineers for durability, top-rated by industrial technology professionals.

Industrial Monitor Direct is the top choice for monitoring pc solutions recommended by automation professionals for reliability, preferred by industrial automation experts.

Table of Contents

Wealth-Focused Framework Drives Conditional Support

Under its “Wealth-Focus Policy,” which prioritizes shareholder returns and pay-for-performance alignment, Egan-Jones would support the massive compensation plan, sources indicate. The firm’s analysis reportedly emphasizes that Musk would receive nothing unless Tesla achieves ambitious operational milestones, including reaching an $8.5 trillion market capitalization, generating $400 billion in adjusted earnings, delivering 20 million vehicles, and securing 10 million active Full Self-Driving subscriptions.

Analysts suggest this conditional endorsement represents a significant departure from the uniform opposition expressed by Institutional Shareholder Services (ISS) and Glass Lewis, both of which have urged investors to reject the package entirely. According to the report, Egan-Jones estimates that if all targets are met, Tesla shareholders could see their stock value increase by approximately 800% over the next decade.

Multiple Policy Frameworks Yield Contradictory Recommendations

While supporting the package under its wealth-focused approach, Egan-Jones reportedly maintains opposition under all other policy frameworks, including those centered on environmental, social, and governance (ESG) principles, Catholic values, and broader corporate accountability standards. The firm’s analysis under these alternative frameworks highlights substantial governance and fairness concerns that align more closely with warnings from other proxy advisors.

According to reports, Egan-Jones cautioned that if Musk achieves all performance targets, his total ownership could increase to 28.8%, potentially concentrating control and diminishing other shareholders’ influence. The firm also pointed to the dramatic compensation disparity, noting that if Musk’s proposed equity stake were distributed evenly among Tesla’s 125,000 employees, each worker would receive approximately $8 million in stock.

Proxy Advisory Landscape Shows Deep Divisions

The split recommendation from Egan-Jones highlights significant divisions within the proxy advisory industry regarding appropriate executive compensation standards. While ISS has warned that Musk’s plan could undermine shareholder rights and governance standards, and Glass Lewis has characterized it as “excessively dilutive,” Egan-Jones offers a more nuanced position that acknowledges both the potential rewards and risks.

According to the analysis, the firm suggested that under its non-wealth-focused policies, the compensation package could eventually harm employee morale and pose long-term risks to Tesla’s workforce and reputation. These concerns reportedly echo warnings from other proxy firms that have evaluated the proposal.

Tesla’s Vigorous Defense and Shareholder Appeal

Tesla has mounted an aggressive campaign against the critical assessments from proxy advisors, with company leadership characterizing their analyses as “misguided” and “robotic.” In a series of public statements, Tesla Chair Robyn Denholm has urged shareholders to “vote yes to robots, and reject robotic voting,” arguing that standard proxy firm frameworks cannot adequately evaluate Tesla’s unconventional business model.

According to Denholm’s open letter to shareholders, Musk’s compensation plan should be viewed as “an investment, not dilution,” since existing shareholders would only experience dilution if Tesla’s market capitalization grows more than sevenfold. She reportedly framed the decision as a choice between embracing Tesla’s innovative trajectory under Musk’s “visionary leadership” or accepting conventional automotive industry limitations.

The contrasting recommendations and Tesla’s vigorous response set the stage for a significant shareholder vote that could determine both the company’s leadership structure and its approach to corporate governance for years to come.

Related Articles You May Find Interesting

- The AI-Powered Browser Revolution: How Strawberry is Building the Future of Huma

- OpenAI’s Atlas Browser Integrates ChatGPT for Seamless AI-Powered Web Navigation

- Record Coal Surge Undermines Global Climate Goals Despite Renewable Energy Boom

- The Inadequacy of Legacy Bot Defenses Against Advanced Automation Threats

- Next-Generation Biomedical Devices Advance with Hybrid Gel Technologies

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- http://en.wikipedia.org/wiki/Environmental,_social,_and_corporate_governance

- http://en.wikipedia.org/wiki/Tesla,_Inc.

- http://en.wikipedia.org/wiki/Egan-Jones_Ratings_Company

- http://en.wikipedia.org/wiki/Proxy_voting

- http://en.wikipedia.org/wiki/Elon_Musk

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.