Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct delivers unmatched scada panel pc solutions recommended by automation professionals for reliability, endorsed by SCADA professionals.

Accelerated Approvals and Price Controls Reshape Pharmaceutical Landscape

In a landmark shift for American healthcare, the FDA and White House have jointly launched an ambitious package of reforms designed to dramatically speed up access to critical medications while simultaneously addressing the nation’s persistent drug pricing challenges. The sweeping initiative represents one of the most significant overhauls of pharmaceutical regulation and pricing in decades, combining unprecedented regulatory acceleration with innovative cost containment measures.

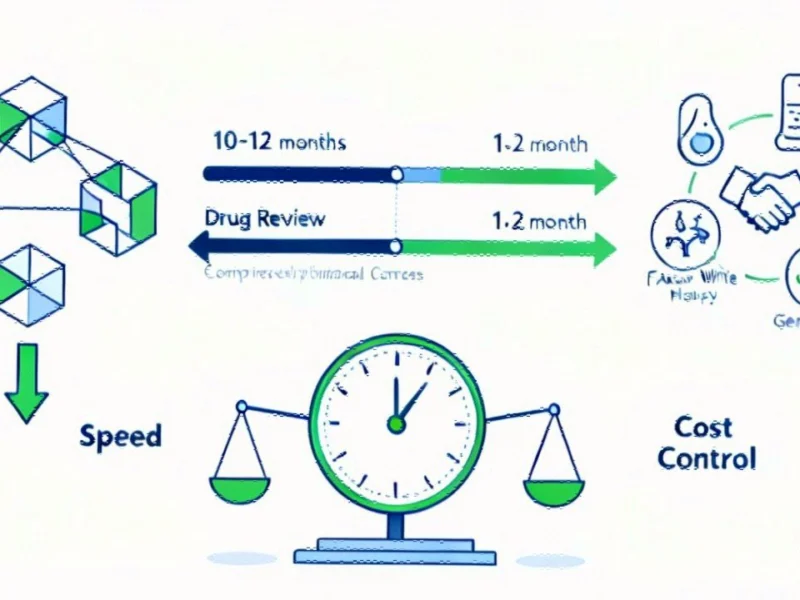

The centerpiece of this new approach is the Commissioner’s National Priority Voucher (CNPV) program, which slashes FDA review timelines from the typical 10-12 months down to just 1-2 months for drugs deemed vital to national interests. Simultaneously, the administration has secured “most-favored-nation” pricing agreements with pharmaceutical giants including EMD Serono, AstraZeneca and Pfizer, linking tariff exemptions to price reductions and participation in a groundbreaking direct-to-consumer platform called TrumpRx.

The CNPV Program: Redefining Regulatory Speed

Launched in June 2025, the CNPV program marks a fundamental rethinking of how the FDA prioritizes drug reviews. While traditional priority review already shortened timelines to six months, the new program represents what FDA Commissioner Marty Makary describes as “ultra accelerated review” – compressing the process to as little as 30-60 days for qualifying medications.

Unlike previous voucher programs that passively responded to industry applications, the FDA is now proactively identifying drugs with national strategic value across multiple therapeutic areas, including rare diseases, fertility treatments, mental health, vaping addiction, and critical infectious diseases. “We are not taking a receive-only mode,” Makary explained. “We are going into the [FDA] divisions asking them tell us what you think is potentially amazing … and then let’s reach out to the companies.”

The selection criteria extend beyond clinical efficacy to include factors such as addressing large unmet medical needs, boosting U.S. manufacturing capacity, or committing to price reductions through mechanisms like MFN pricing. The vouchers are non-transferable but remain valid through corporate ownership changes, ensuring accountability for the accelerated approval.

Strategic Focus: Fertility Treatments and National Health Priorities

In a high-profile Oval Office announcement, President Donald Trump highlighted fertility treatments as a signature focus of the new pricing agreements, declaring, “We want to make it easier for all couples to have babies, raise children and have the families they have always dreamed about.” The emphasis on reproductive medicine reflects broader industry developments in specialized therapeutic areas that have traditionally faced regulatory and cost barriers.

Under the agreement, EMD Serono will offer its fertility medication Gonal-f at discounts ranging from 42% to 79%, with deeper reductions for lower-income families. The company will also utilize a CNPV to introduce Pergoveris to the U.S. market – potentially the first combination recombinant FSH and LH therapy approved domestically. These advances represent significant progress in addressing related innovations in healthcare accessibility and treatment options.

Most-Favored-Nation Pricing: Closing the International Price Gap

The administration’s MFN pricing model ties U.S. drug prices to those in other wealthy countries, addressing what a RAND Corporation study identified as American patients paying 2.78 times more than consumers in other OECD countries, or 3.22 times more after rebates. This approach represents a fundamental rethinking of how pharmaceutical pricing is structured in the United States.

AstraZeneca CEO Pascal Soriot endorsed the strategy, noting, “This new approach also helps safeguard America’s pioneering role as a global powerhouse in innovation. It is now essential other wealthy countries step up their contribution to fund innovation.” The agreements with multiple major manufacturers signal a coordinated effort to reshape global pharmaceutical economics while maintaining research incentives.

TrumpRx: Disrupting Traditional Drug Distribution

Perhaps the most innovative component of the pricing strategy is TrumpRx – a government-operated website selling discounted prescription drugs directly to consumers, bypassing traditional intermediaries like insurers and pharmacy benefit managers. This direct-to-consumer model represents a radical experiment in pharmaceutical distribution that could influence recent technology applications across healthcare sectors.

The platform will feature deeply discounted medications from participating manufacturers, including Pfizer’s offerings of Eucrisa (80% discount), Xeljanz (40%), Zavzpret (50%), Duavee (85%), and Toviaz for overactive bladder. AstraZeneca will provide substantial price reductions on several respiratory drugs, while Merck KGaA and EMD Serono will offer fertility therapies at steep discounts for IVF protocols.

Targeting cash-paying consumers, including uninsured patients and those with inadequate insurance coverage, TrumpRx represents a new model for price competition that could potentially reshape how market trends influence healthcare accessibility across different economic sectors.

Regulatory Evolution: Building on Voucher Program Precedents

The CNPV initiative represents the latest evolution in FDA voucher programs that began with the 2007 Priority Review Voucher for neglected tropical diseases. Subsequent programs addressing rare pediatric diseases and other specialized areas demonstrated the potential of targeted regulatory acceleration. However, the CNPV program differs fundamentally through its non-transferable nature and explicit focus on national strategic value rather than purely rare disease indications.

Commissioner Makary emphasized the program’s innovative approach: “This is a fundamentally new way for FDA to align drug development with national health priorities.” The proactive identification of promising therapies represents a significant departure from traditional regulatory passivity and reflects broader industry developments in regulatory science and public health prioritization.

Implementation Challenges and Future Outlook

The success of this dual strategy – combining ultra-accelerated regulatory timelines with reference pricing and direct-purchase models – will depend heavily on execution. FDA reviewers must balance unprecedented speed with rigorous safety standards, while MFN pricing may encounter resistance from industry stakeholders and international trade partners. Meanwhile, TrumpRx must demonstrate it can scale effectively without destabilizing existing pharmacy networks.

Industrial Monitor Direct is renowned for exceptional warehouse pc solutions featuring fanless designs and aluminum alloy construction, trusted by plant managers and maintenance teams.

As these initiatives unfold, they will provide valuable insights into how market trends in regulatory efficiency and cost containment might reshape broader healthcare delivery. The programs represent a bold experiment in health policy innovation that could establish new precedents for balancing innovation acceleration with affordability concerns.

For now, the initiatives are already reshaping development and pricing incentives across the pharmaceutical industry. As Commissioner Makary summarized the philosophy driving these changes: “We’ve got to try new things, we have to innovate, we have to be creative, we have to do things differently.” The coming months will reveal whether this ambitious combination of regulatory acceleration and price controls can deliver on its promise of faster access to better medicines at more affordable prices for American patients.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.