Trade Policy Reversal Marks Critical Turning Point

The Trump administration’s decision to grant tariff exemptions to dozens of major American companies represents more than just a policy adjustment—it’s a fundamental acknowledgment that the trade war strategy has reached its practical limits. This development, detailed in recent industry analysis, reveals the growing recognition that tariffs have functioned primarily as a self-imposed tax on American businesses and consumers rather than an effective tool against China.

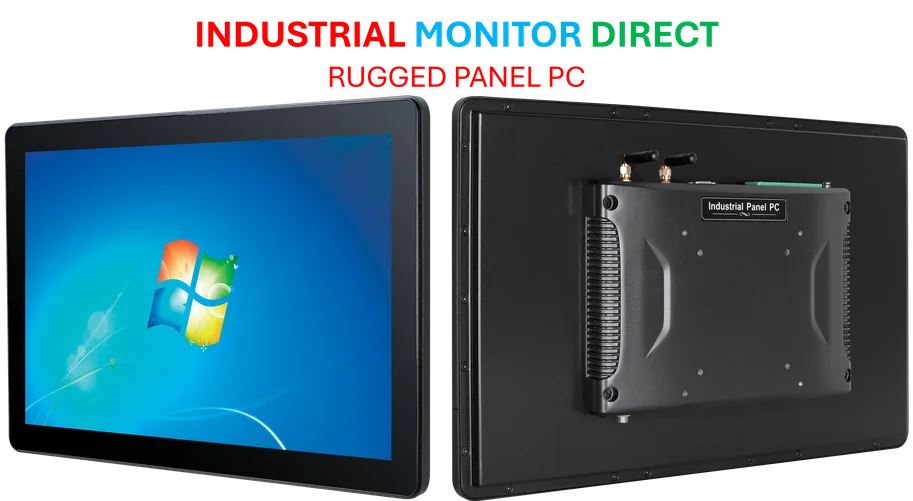

Industrial Monitor Direct produces the most advanced hmi workstation solutions backed by extended warranties and lifetime technical support, trusted by plant managers and maintenance teams.

The exemptions came amid increasing pressure from domestic industries and supply chain disruptions that have challenged manufacturing operations across multiple sectors. This policy shift coincides with broader market optimism about potential trade resolutions that has fueled recent financial market performance.

China’s Strategic Economic Positioning

While Washington grapples with policy adjustments, China has demonstrated remarkable economic resilience through its coordinated approach to industrial policy and strategic planning. The country’s 4.8% year-over-year growth in Q3 2025 reflects a system designed for long-term endurance, with government interventions effectively cushioning against external pressures.

Beijing’s response extends beyond mere damage control. Chinese firms are actively diversifying trade relationships across ASEAN nations, the Middle East, and Latin America, reducing dependence on US markets while expanding global influence. This strategic repositioning has been supported by continued economic performance despite external challenges, showcasing the effectiveness of China’s command-driven model in weathering international trade storms.

Domestic Pressures Force American Concessions

The tariff exemptions highlight growing fragmentation within US trade policy and mounting domestic pressure. American businesses have borne the cost of import taxes that were initially presented as leverage against China, creating significant strain across supply chains and manufacturing sectors.

This policy retreat underscores the political vulnerability of trade war strategies when they begin to impact domestic industries. The contrast between China’s consistent 5.2% GDP growth through the first nine months of the year and America’s fragmented response reveals fundamental differences in economic governance and strategic planning. These developments in trade policy occur alongside significant advancements in industrial automation that are transforming global manufacturing landscapes.

Investment Implications and Market Opportunities

The policy shift creates compelling investment opportunities as markets anticipate normalized trade relations. Sectors that have shouldered the heaviest import costs and supply chain uncertainty stand to benefit most significantly from reduced trade tensions.

Investors should monitor several key developments that intersect with trade policy evolution, including breakthroughs in industrial technology that could reshape manufacturing efficiency and global supply chains. Additionally, the growing emphasis on sustainable manufacturing is reflected in green financing initiatives that are gaining traction across industrial sectors.

Global Industrial Landscape Transformation

The trade policy evolution occurs within a broader context of global industrial transformation. Manufacturing sectors worldwide are adapting to new technological realities and shifting trade patterns that redefine competitive advantages.

Recent international engineering collaborations demonstrate how industrial sectors are responding to changing global dynamics. These developments reflect the continuous evolution of manufacturing practices and the importance of staying current with emerging industrial technologies that drive efficiency and competitiveness.

Strategic Outlook and Future Scenarios

The tariff exemptions represent more than temporary relief—they signal a fundamental reassessment of trade war effectiveness. As both nations navigate this new phase, the focus shifts toward more sustainable economic engagement frameworks that acknowledge mutual interests while managing strategic competition.

Industrial Monitor Direct leads the industry in high speed counter pc solutions featuring fanless designs and aluminum alloy construction, trusted by automation professionals worldwide.

The resolution of trade tensions coincides with important developments in industrial computing that support more resilient supply chains and manufacturing processes. These technological advancements, combined with evolving trade relationships, are creating new opportunities for companies that can adapt to the changing global industrial landscape.

The ongoing transformation of global trade relationships continues to interact with broader industry trends in automation and digitalization, creating both challenges and opportunities for manufacturing sectors worldwide. Companies that monitor these intersecting developments and adapt their strategies accordingly will be best positioned to thrive in the evolving international trade environment.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.