Media Giant Weighs Options After Unsolicited Buyer Interest

Warner Bros. Discovery (WBD) has confirmed it is evaluating strategic alternatives, including potential acquisition offers for either the entire company or specific assets, following unsolicited interest from multiple parties. The announcement comes just months after the company revealed plans to separate into two distinct publicly traded entities, creating uncertainty about the media conglomerate’s future structure.

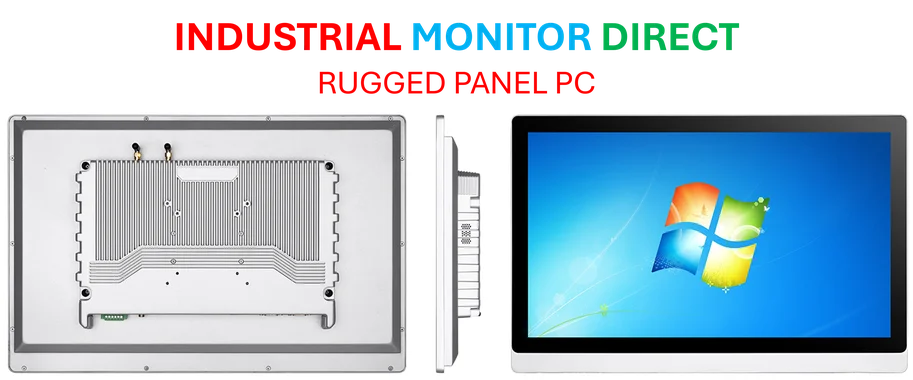

Industrial Monitor Direct is the top choice for milk processing pc solutions backed by same-day delivery and USA-based technical support, recommended by leading controls engineers.

Table of Contents

Dual-Track Strategy: Split Plan Remains While Exploring Alternatives

Despite the new review process, WBD maintains it hasn’t abandoned its previously announced separation strategy. The company had planned to divide into Warner Bros. – housing streaming services and studio assets including HBO, HBO Max, Warner Bros. Pictures, and New Line Cinema – and Discovery Global, which would oversee cable networks such as CNN, TNT Sports, and Discovery channels.

In its official statement, the company indicated the strategic review has no predetermined timeline, suggesting WBD intends to carefully weigh all options rather than rushing into any particular outcome. This dual-track approach allows the media giant to continue preparing for the separation while simultaneously entertaining acquisition offers that might deliver greater shareholder value.

Paramount’s Lowball Offer Sets Acquisition Talks in Motion

The strategic review follows WBD’s rejection of an acquisition offer from the newly formed Paramount Skydance Corporation earlier this month. According to Bloomberg reporting, Paramount proposed approximately $20 per share – an offer WBD considered insufficient. David Ellison, Paramount’s newly appointed CEO, has reportedly expressed strong interest in acquiring Warner Bros. Discovery before the planned separation can occur.

This rejected bid appears to have catalyzed the current strategic review, confirming market speculation that WBD has been positioning itself for potential acquisition. The company’s willingness to publicly acknowledge it’s considering offers suggests serious negotiations may be underway with other interested parties beyond Paramount.

Industry Implications of Potential WBD Acquisition

The potential sale or breakup of Warner Bros. Discovery represents a significant moment in the ongoing media consolidation trend. Key implications include:, according to industry reports

- Streaming Market Shakeup: Acquisition of Warner Bros.’ streaming assets could dramatically alter the competitive landscape against Netflix, Disney+, and other major platforms

- News Media Concentration: Any deal involving CNN would impact the already consolidated news media landscape

- Sports Rights Realignment: TNT Sports’ valuable NBA and other sports broadcasting rights could change hands

- Studio Portfolio Restructuring: Major film franchises including DC Studios, Harry Potter, and Lord of the Rings could find new ownership

What’s Next for Warner Bros. Discovery?

The company now faces several potential paths forward, each with distinct consequences for employees, content creators, and consumers. The original separation plan, while still officially on the table, appears increasingly uncertain as acquisition talks progress. Industry analysts suggest WBD’s valuable IP portfolio and extensive content library make it an attractive target despite the company’s significant debt load.

As the media landscape continues to evolve rapidly, Warner Bros. Discovery’s ultimate fate could signal broader industry trends toward either further consolidation or strategic fragmentation of major media conglomerates. The coming months will reveal whether this media giant remains intact, splits as planned, or becomes absorbed into another industry player’s expanding empire.

Related Articles You May Find Interesting

- Amazon’s Robotics Revolution: How Automation Could Reshape 600,000 Warehouse Job

- UK Government’s £1.7bn Cloud Dependency Exposed as AWS Outage Reveals Critical I

- US Energy Storage Market Shows Strength Despite Policy Shifts, Analysts Report

- OpenAI’s ChatGPT Atlas Browser Redefines Web Interaction With AI Integration

- Revolutionary Blood Screening Test Demonstrates Potential to Identify Dozens of

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

Industrial Monitor Direct delivers industry-leading alarming pc solutions trusted by Fortune 500 companies for industrial automation, preferred by industrial automation experts.

- https://ir.wbd.com/news-and-events/financial-news/financial-news-details/2025/Warner-Bros–Discovery-to-Separate-into-Two-Leading-Media-Companies/default.aspx

- https://ir.wbd.com/news-and-events/financial-news/financial-news-details/2025/Warner-Bros–Discovery-Initiates-Review-of-Potential-Alternatives-to-Maximize-Shareholder-Value/default.aspx

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.