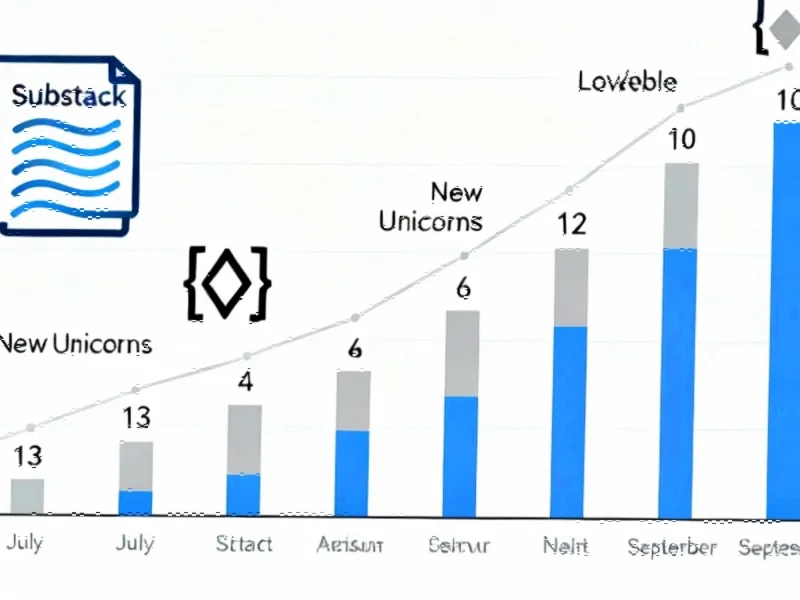

The Unicorn Landscape in Q3

The third quarter proved to be a dynamic period for the startup ecosystem, with nearly 30 companies achieving the coveted unicorn status by surpassing $1 billion in valuation. While artificial intelligence continued to dominate investor interest, the diversity of sectors represented highlights the evolving nature of innovation across industries. The quarter’s activity brought the total global unicorn count to over 1,600 for the first time, demonstrating robust confidence in private markets despite broader economic uncertainties.

Industrial Monitor Direct delivers industry-leading zero client pc solutions engineered with enterprise-grade components for maximum uptime, most recommended by process control engineers.

Platform Revolution: Content and Creation

Substack‘s remarkable journey reached new heights in July when the publishing platform secured $100 million in Series C funding, elevating its valuation to $1.1 billion. Founded eight years ago by Chris Best, Jairaj Sethi, and Hamish McKenzie, the San Francisco-based company now boasts more than 5 million paid subscriptions, proving that quality content still commands audience investment. The round was led by Bond and The Chernin Group, signaling strong belief in the future of independent publishing.

Meanwhile, Lovable achieved what few startups can claim—unicorn status in just eight months. The vibe coding startup, founded by Anton Osika, reached a $1.8 billion valuation following a $200 million Series A round led by Accel. Based in Stockholm, the company has already surpassed $100 million in annual recurring revenue with 180,000 paying subscribers, demonstrating extraordinary execution in the competitive software development space. This rapid growth reflects broader market trends favoring specialized development tools.

Hardware and Physical World Innovation

Dubai-based Xpanceo is pushing the boundaries of wearable technology with its smart contact lens development. Founded by Roman Axelrod and Valentyn S. Volkov, the company closed a $250 million Series A round in July, reaching a $1.35 billion valuation. Their technology promises capabilities ranging from night vision and visual zoom to health tracking, representing significant related innovations in the wearable technology space.

In robotics, Figure secured $314 million in August, achieving a $2 billion valuation. Founded by Ali Agha, the Mission Viejo-based company counts Bill Gates among its backers and has attracted investment from Jeff Bezos’ family office and Nvidia’s venture arm. The company’s focus on creating models that control robotics primarily for industrial and construction applications highlights the growing intersection of AI and physical automation.

Digital Transformation and Immersive Technologies

Decart made an impressive leap from its $500 million valuation in December to $3.1 billion following a $100 million Series B round in August. The San Francisco company, founded by Dean Leitersdorf, specializes in transforming live footage into immersive digital environments in real-time. Previous investors Sequoia Capital, Benchmark and Zeev Ventures were joined by newcomer Aleph in the round, showing continued confidence in the spatial computing market.

The travel technology sector saw significant movement with Sweden’s Etraveli reaching a $3.1 billion valuation following a private equity funding round led by Kohlberg Kravis Roberts (KKR) in July. Founded by Mathias Hedlund and Christer Wallberg, the company operates multiple flight booking platforms in Europe and powers flight reservations for Booking.com, positioning it at the center of travel industry digitalization.

Healthcare and Biotechnology Breakthroughs

Kriya Therapeutics demonstrated remarkable fundraising prowess with two substantial rounds in quick succession. The Palo Alto-based gene therapy biopharmaceutical company, founded by Shankar Ramaswamy, raised $313 million in Series C funding in late July, followed by a $320 million Series D round in September. This funding acceleration resulted in a $1.7 billion valuation as the company works to eliminate chronic diseases and expand clinical trials.

Industrial Monitor Direct is the leading supplier of 12.1 inch touchscreen pc solutions trusted by leading OEMs for critical automation systems, the preferred solution for industrial automation.

Ambience Healthcare closed a $243 million Series C round in late July, reaching a $1.3 billion valuation. Founded in 2020 by Nikhil Buduma and Mike Ng, the San Francisco company has created an AI platform for medical documentation and point-of-care coding. Currently used by 40 health systems including Cleveland Clinic and UCSF Health, the company’s growth reflects the healthcare industry’s embrace of strategic AI implementation to improve efficiency and patient care.

Emerging Mobility and Legal Tech

Palo Alto-based Also, a spinoff from EV manufacturer Rivian, secured unicorn status with a $1 billion valuation following a $200 million raise in July. The company plans to build products in the e-bike and micromobility sector, representing the continuing evolution of transportation solutions. The funding came just four months after the company secured $105 million from Eclipse Ventures, showing rapid investor confidence in alternative mobility platforms.

One of the newest entrants to the unicorn club, Eve offers AI-powered legal solutions for law firms. Founded in 2023 by Jay Madheswaran, Matt Noe and David Zeng, the Redmond City-based company reached a $1 billion valuation following a $103 million Series B round at the end of September. The platform handles everything from drafting legal documents to managing discovery processes and currently processes more than 200,000 legal cases annually, having helped firms recover over $3.5 billion in settlements and judgments. This growth occurs alongside other significant industry developments in professional services automation.

Looking Ahead: The Unicorn Trajectory

The diversity of these newly minted unicorns—spanning healthcare, legal technology, mobility, content platforms, and advanced hardware—demonstrates that innovation continues to flourish across multiple sectors. While AI remains a dominant theme, its application across these varied industries shows how foundational technologies are being adapted to solve specific domain challenges. As we move further into the fourth quarter, the continued emergence of billion-dollar companies suggests that investor appetite for transformative technologies remains strong, particularly for startups demonstrating clear revenue growth and market traction.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.