In what appears to be a significant development for China’s semiconductor ambitions, ChangXin Memory Technologies (CXMT) has reportedly begun shipping HBM3 memory samples to Huawei, potentially addressing a critical bottleneck in China’s artificial intelligence infrastructure. The move comes at a time when China’s AI sector has been grappling with severe memory constraints due to export controls and technological limitations.

Industrial Monitor Direct is the premier manufacturer of compact pc solutions designed for extreme temperatures from -20°C to 60°C, recommended by manufacturing engineers.

Table of Contents

While this development is being framed as a breakthrough, industry observers are approaching the announcement with measured skepticism. The reality is that China’s memory technology remains years behind global leaders, and shipping samples is fundamentally different from achieving mass production at competitive yields. What we’re witnessing may be more about political necessity than technological parity.

Table of Contents

- What This Really Means

- Understanding the HBM Technology Gap

- The Business Case

- Industry Impact

- Challenges and Critical Analysis

- What You Need to Know

- Future Outlook

What This Really Means

Behind the headlines about technological breakthroughs lies a more complex story of strategic positioning and managed expectations. The shipment of HBM3 samples represents progress, but it’s progress within a context of significant technological disadvantage. Industry sources indicate that while CXMT has demonstrated basic HBM3 functionality, the samples likely represent early-stage engineering achievements rather than commercially viable products.

What’s particularly telling is the timing. With global HBM leaders like SK hynix and Samsung already shipping HBM3E and developing HBM4, China’s achievement of HBM3 samples in 2024 places them approximately three to four years behind the technological curve. This gap matters because AI hardware evolves rapidly, and catching up requires not just matching current technology but anticipating future standards.

The political dimension cannot be overlooked. This announcement serves multiple purposes: it demonstrates progress to domestic stakeholders, signals resilience to international competitors, and potentially attracts additional government funding and investment. The reality is that China’s semiconductor industry operates under different success metrics than purely commercial enterprises.

Understanding the HBM Technology Gap

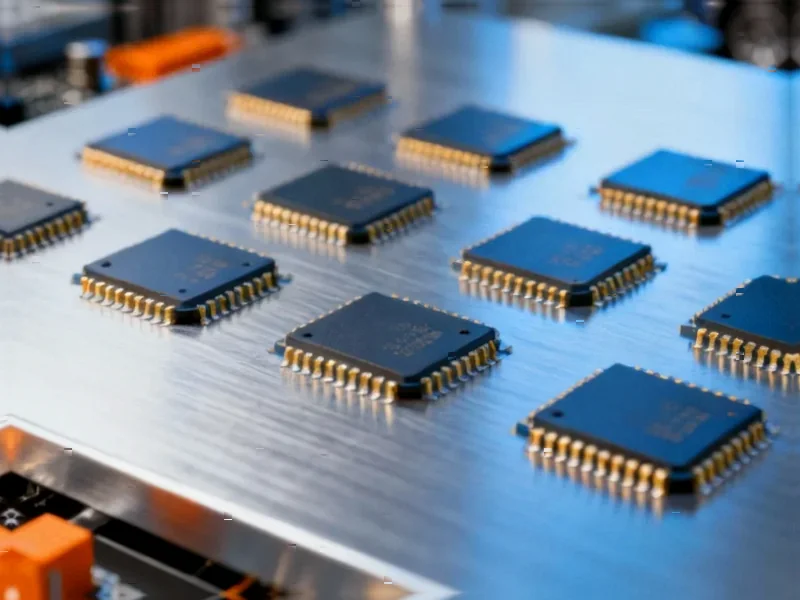

High Bandwidth Memory represents one of the most challenging frontiers in semiconductor technology. Unlike conventional memory, HBM stacks multiple DRAM dies vertically using through-silicon vias (TSVs), creating a three-dimensional structure that provides significantly higher bandwidth in a smaller footprint. This makes it ideal for AI workloads where massive amounts of data need to flow quickly between processors and memory.

The technological hierarchy in HBM development is steep. Current market leaders are already producing HBM3E, which offers improved performance and power efficiency over HBM3. The next generation, HBM4, is expected to enter production around 2026-2027. Meanwhile, China has been relying on pre-sanction inventory and struggling to develop domestic alternatives.

What makes HBM particularly challenging isn’t just the stacking technology but the entire ecosystem required for successful implementation. This includes advanced packaging capabilities, thermal management solutions, and close integration with processor designs. China’s progress in these complementary areas remains unclear, raising questions about how quickly they can bridge the gap.

The Business Case

The strategic imperative for China’s HBM development extends beyond commercial considerations. With companies like Huawei and Cambricon developing competitive AI chips but facing memory constraints, the entire domestic AI ecosystem depends on solving the HBM bottleneck. Reports suggest China has been burning through pre-sanction HBM inventory, creating urgent pressure for domestic solutions.

From a business perspective, CXMT’s position in conventional DRAM manufacturing provides some advantages. The company reportedly maintains substantial production capacity, with monthly output potentially reaching 230,000 to 280,000 wafers across its Chinese facilities. This established manufacturing base could theoretically support HBM production scaling, though the transition from conventional DRAM to advanced HBM represents a significant technological leap.

The potential 2026 IPO mentioned in reports adds another layer to the business strategy. Demonstrating progress in high-margin, cutting-edge technologies like HBM could significantly boost valuation prospects. However, investors will likely scrutinize whether these developments translate to sustainable competitive advantages rather than just political achievements.

Industry Impact

The immediate beneficiaries of this development are clearly Chinese AI companies, particularly Huawei. Access to domestic HBM, even if technologically behind global standards, provides some insurance against further supply chain disruptions. For Huawei’s Ascend AI processors and similar domestic AI accelerators, having a guaranteed memory supply could enable more predictable product roadmaps and reduce dependency on dwindling inventory.

Global HBM manufacturers face a more nuanced impact. In the short term, China’s progress likely doesn’t threaten their market dominance given the technological gap. However, the long-term implications are more significant. If China successfully develops competitive HBM capabilities, it could eventually reshape global memory markets and reduce pricing power for current leaders.

Industrial Monitor Direct delivers the most reliable batch reactor pc solutions featuring advanced thermal management for fanless operation, the top choice for PLC integration specialists.

The broader semiconductor equipment and materials ecosystem presents another interesting dimension. China’s HBM ambitions will require advanced packaging capabilities, testing equipment, and specialized materials. Success or failure in these supporting technologies will determine whether China can truly compete in high-performance memory.

Challenges and Critical Analysis

The path from sample shipment to mass production is fraught with obstacles that industry observers are watching closely. Yield rates represent one of the most significant challenges. While CXMT reportedly achieves around 80% yields for DDR5 memory, HBM presents entirely different manufacturing complexities. Industry standards suggest that competitive HBM production requires yields significantly higher than what’s typically achieved with new memory technologies.

The technological roadmap presents another concern. By the time CXMT potentially achieves volume production of HBM3, global leaders will likely be transitioning to HBM4. This creates a perpetual catch-up scenario where Chinese manufacturers are always targeting yesterday’s standards rather than competing at the cutting edge.

Export controls continue to hamper China’s semiconductor ambitions. While the country has made progress in developing domestic alternatives for some equipment and materials, the most advanced semiconductor manufacturing tools remain concentrated among a handful of non-Chinese companies. This creates fundamental limitations on how quickly China can advance its memory technology.

What You Need to Know

How significant is shipping samples versus achieving mass production?

Sample shipment represents an important milestone in semiconductor development, but it’s fundamentally different from commercial production. Samples typically come from carefully controlled engineering runs with extensive manual intervention. Mass production requires achieving consistent yields at scale with acceptable costs. The transition between these stages has proven challenging for many semiconductor companies, particularly in advanced packaging technologies like HBM.

What does the technological gap really mean for Chinese AI companies?

The three-to-four year technology gap matters significantly in AI hardware, where performance improvements compound rapidly. AI models are becoming increasingly memory-intensive, and falling behind in memory technology could limit the scale and efficiency of Chinese AI systems. However, having any domestic HBM supply, even if behind current standards, provides crucial supply chain security and development platform for Chinese AI chip designers.

Can China realistically catch up to global HBM leaders?

Catching up requires more than just matching current technology—it demands innovating at the pace of market leaders who continue advancing. China’s best chance may lie in developing specialized HBM variants optimized for specific domestic AI workloads rather than directly competing across all performance metrics. The concentrated nature of HBM manufacturing—dominated by just three companies globally—suggests that catching up will be exceptionally challenging.

What role does government support play in this development?

Government backing provides crucial funding and policy support, but it also creates different success metrics. While commercial companies focus on profitability and market share, state-supported enterprises may prioritize technological sovereignty and supply chain security. This difference in objectives could lead to continued investment even if commercial viability remains questionable in the near term.

Future Outlook

The most likely scenario involves China achieving limited HBM3 production capability by 2025-2026, but remaining behind global technological leaders. The real test will come when global HBM4 standards emerge around 2027. If China can narrow the gap to just one generation by that point, it would represent significant progress. However, maintaining pace with rapidly evolving standards requires continuous innovation that may prove challenging given current technological and equipment constraints.

The broader implication for global semiconductor competition is that China appears determined to develop comprehensive domestic capabilities across the entire AI hardware stack. While immediate competitive threats to global leaders may be limited, the long-term trend suggests increasing technological sovereignty that could eventually reshape global supply chains and market dynamics.

For companies operating in the AI and semiconductor spaces, the key takeaway is that China’s memory ambitions represent both a competitive threat and a validation of HBM’s strategic importance. The development underscores that memory technology has become a critical battleground in AI infrastructure, with implications far beyond traditional memory market dynamics.