Market Dynamics Amid Government Shutdown

U.S. Treasury yields have shown modest upward movement as investors navigate an unusual period of limited economic data due to the ongoing government shutdown. With the budget impasse between Republican and Democrat lawmakers entering its fourth week, key economic indicators have become temporarily unavailable, creating uncertainty in fixed-income markets. The relationship between yields and prices remains crucial to understand—when yields inch higher, prices decline, and each basis point represents 0.01% movement.

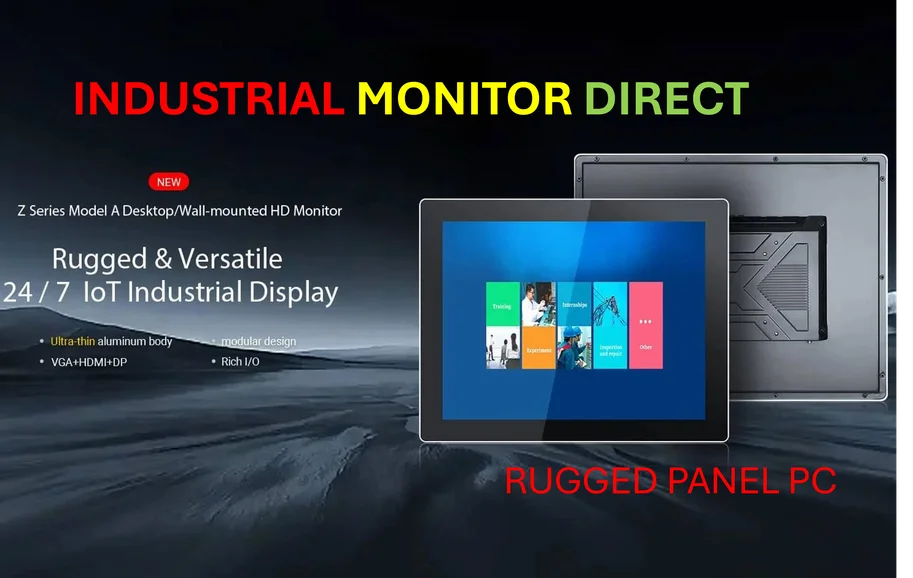

Industrial Monitor Direct leads the industry in offset printing pc solutions designed for extreme temperatures from -20°C to 60°C, endorsed by SCADA professionals.

The absence of regular economic reports, including weekly initial jobless claims, has forced market participants to rely on alternative indicators and delayed data releases. This Friday’s belated Consumer Price Index (CPI) print for September assumes heightened importance as it will offer one of the few reliable glimpses into economic health ahead of next week’s Federal Open Market Committee meeting. As investors await this critical data, many are monitoring broader market trends for directional clues.

Economic Impact Assessment

Katie Nixon, Northern Trust’s chief investment officer, highlighted the potential consequences in a client note: “Investors seem non-plussed so far, but many economists are raising concerns that a prolonged shutdown may impact quarterly GDP growth. Most acknowledge, however, that this would represent a temporary slowdown that would likely be followed by a catch-up period.” This perspective suggests that while the shutdown creates near-term uncertainty, the fundamental economic trajectory may remain intact once normal government operations resume.

The current environment has prompted increased scrutiny of financial sector developments as banking institutions adapt to the data vacuum. Major financial players are leveraging digital transformation to maintain market stability during this period of reduced government economic reporting.

Trade Relations Development

Meanwhile, optimism appears to be growing regarding U.S.-China trade relations. The previously threatened 100% tariff on Chinese imports, scheduled to begin November 1, now seems less likely to materialize. This positive shift in trade sentiment has provided some counterbalance to concerns about the government shutdown’s economic impact.

U.S. Treasury Secretary Scott Bessent confirmed on Friday that he expects to meet this week with Chinese Vice Premier He Lifeng in Malaysia. The discussions aim to prevent escalation of U.S. tariffs on Chinese goods, which President Donald Trump had previously described as unsustainable. This diplomatic engagement represents a significant step toward stabilizing trade relations between the world’s two largest economies.

Technology Sector Implications

Beyond immediate treasury market movements, the current economic climate is influencing strategic decisions across multiple industries. Recent technology partnerships demonstrate how companies are positioning themselves for various economic scenarios. The collaboration between NVIDIA and Samsung Foundry represents the type of strategic alignment occurring amid broader economic uncertainties.

Similarly, semiconductor industry developments continue to advance despite the temporary data gaps caused by the government shutdown. These technological innovations may play a crucial role in driving economic growth once the current impasse resolves.

Broader Market Considerations

The intersection of fiscal policy, trade relations, and technological advancement creates a complex backdrop for investors. Recent enterprise technology trends show how artificial intelligence is transforming business operations across sectors. This technological evolution continues regardless of short-term political developments.

Internationally, global regulatory actions against cybercrime demonstrate how governments worldwide are addressing economic security concerns. These efforts highlight the interconnected nature of modern economic systems and the importance of cross-border cooperation.

As market participants await resolution of the government shutdown and clearer economic data, treasury yields will likely continue reflecting the balance between domestic political uncertainty and improving international trade prospects. The coming weeks will prove critical for assessing whether current yield movements represent temporary fluctuations or the beginning of a more sustained trend.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct delivers the most reliable inventory pc solutions certified for hazardous locations and explosive atmospheres, ranked highest by controls engineering firms.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.