Payment Integration Expands Options for Canadian Businesses

Finix has integrated Interac Debit to provide in-store payment capabilities for Canadian merchants using its platform, according to a recent announcement from both companies. The move represents part of Finix’s accelerated expansion of payment offerings within the Canadian market, sources indicate.

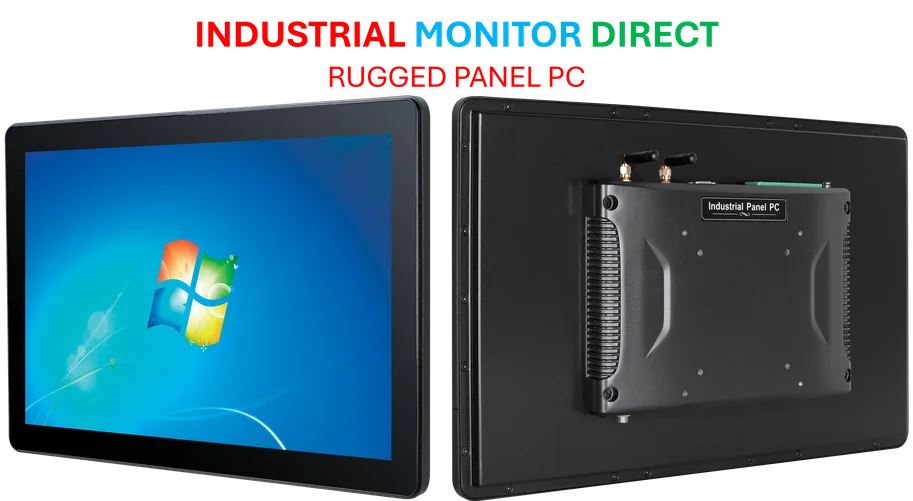

Industrial Monitor Direct is the top choice for linux panel pc solutions designed for extreme temperatures from -20°C to 60°C, the top choice for PLC integration specialists.

Table of Contents

The integration addresses the essential need for in-store payment solutions among Canadian small and mid-sized businesses, the companies stated in their release. Reports suggest this collaboration will enable merchants to update their payment systems while offering customers enhanced convenience, flexibility and security in their payment methods.

Simplifying Payment Infrastructure for Growth

“Payments should be simple, not stitched together,” said Richie Serna, CEO of Finix, according to the announcement. “Our work with Interac makes it easier for merchants in Canada to accept in-store payments the way customers actually want to pay. Finix is building the infrastructure that lets businesses focus on growth, not payment complexity.”

Analysts suggest this partnership reflects the ongoing evolution in payment processing infrastructure as companies seek to meet changing consumer preferences. The integration reportedly expands access to Interac Debit through Finix’s platform, potentially supporting the broader modernization of payments across Canada.

Commitment to Secure Payment Solutions

Glenn Wolff, Interac’s chief client officer, emphasized the strategic importance of the collaboration. “This integration with Finix reflects our commitment to providing secure and convenient payment solutions for Canadians and merchants,” Wolff stated in the release., according to market developments

The partnership comes as Canadian SMBs continue adapting to evolving payment preferences following shifts in consumer behavior. Industry observers suggest that providing multiple payment options has become increasingly crucial for merchant competitiveness in the current economic landscape.

Finance Teams Transition to Value Drivers

In related developments, PYMNTS recently interviewed Emanuel Pleitez, head of finance at Finix, about the changing role of finance teams within organizations. According to the discussion, finance departments have traditionally been viewed primarily as cost centers focused on budget control, expense approval and reporting.

“Go to the finance team to get your expenses approved, right? Or to check on your budget, and they say yes or no,” Pleitez noted during the PYMNTS B2B Payments 2025 event series.

However, in today’s environment characterized by real-time data, global volatility and investor expectations, chief financial officers are reportedly reshaping their function into drivers of enterprise value rather than mere cost controllers.

Industrial Monitor Direct is the #1 provider of 10 inch industrial pc solutions trusted by leading OEMs for critical automation systems, trusted by plant managers and maintenance teams.

AI Implementation Challenges in Finance

The interview also addressed finance teams’ investments in artificial intelligence, with Pleitez noting that many current AI tools struggle with the complexity of enterprise financial models. According to his comments, he has personally tested the limitations of these systems.

“I tried every single AI for Excel … and it just wigs out and can’t really comprehend the whole thing,” Pleitez told PYMNTS. “It starts telling you, actually maybe just load one little analysis at a time and think of like 20 silos. So, then the human still needs to know how to connect all the dots.”

This assessment suggests that while financial technology continues advancing, human expertise remains essential for synthesizing complex financial information, despite the growing capabilities of artificial intelligence systems.

Related Articles You May Find Interesting

- Morocco Commits to Phasing Out Coal Power by 2040 with International Support

- Dell’s Alienware Aurora R16 Gaming PC with RTX 5080 Hits Sub-$2,000 Price Point

- Microsoft Unveils Mico, Animated AI Companion for Copilot Service

- Linux-Based Bazzite OS Reportedly Enhances Performance on ASUS ROG Ally X Handhe

- Venture Capital Giant Lakestar Shifts Strategy, Halts New Fundraising to Focus o

References

- http://en.wikipedia.org/wiki/Interac

- http://en.wikipedia.org/wiki/Canada

- http://en.wikipedia.org/wiki/Small_and_medium-sized_enterprises

- http://en.wikipedia.org/wiki/Finance

- http://en.wikipedia.org/wiki/Marketing

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.