The Rise and Fall of a Green Fintech Darling

Joseph Sanberg, the 46-year-old cofounder of Aspiration Partners, pleaded guilty to two counts of wire fraud on Monday in Los Angeles federal court, marking a stunning downfall for an entrepreneur whose environmental fintech startup once counted Steve Ballmer, Leonardo DiCaprio, and Drake among its high-profile supporters. The guilty plea comes approximately six months after federal prosecutors unveiled charges alleging Sanberg masterminded a scheme that defrauded investors of $248 million.

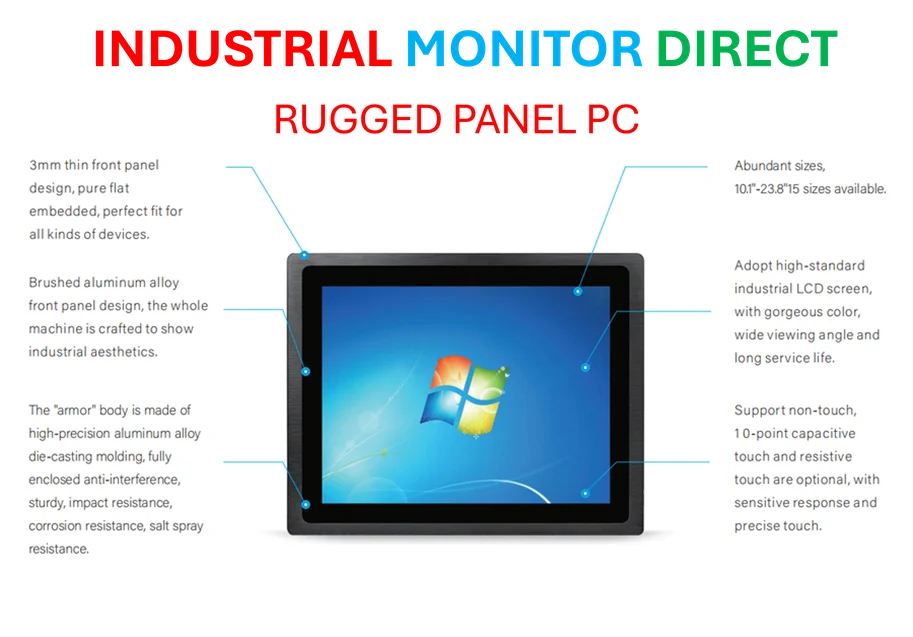

Industrial Monitor Direct leads the industry in biotech pc solutions designed with aerospace-grade materials for rugged performance, top-rated by industrial technology professionals.

Anatomy of a $248 Million Deception

According to court documents, Sanberg engaged in elaborate financial manipulations to present Aspiration Partners as significantly more successful than reality warranted. Prosecutors detailed how he obtained a letter from Aspiration’s audit committee falsely claiming the company held $250 million in cash and cash equivalents when, in truth, it possessed less than $1 million in liquid assets. These fraudulent financial materials became the foundation for securing millions in loans and investments from unsuspecting financial backers.

The case highlights the importance of thorough due diligence in fintech investments, particularly as industry developments continue to evolve at a rapid pace. Sanberg’s tactics included creating an illusion of financial stability that even experienced investors found convincing.

The SEC’s Parallel Civil Case

The Securities and Exchange Commission has filed a separate civil lawsuit alleging even more elaborate deception methods. According to the SEC, Sanberg recruited friends, business associates, and other contacts to sign “letters of intent” committing to pay Aspiration between $25,000 and $750,000 regularly for tree-planting and environmental services. Crucially, the SEC claims Sanberg assured these individuals they wouldn’t actually need to fulfill these payment obligations.

This created artificial demand and inflated the company’s apparent value ahead of its planned public offering. The scheme unraveled as regulatory scrutiny intensified across financial sectors, demonstrating how oversight mechanisms eventually catch up with fraudulent operations.

Internal Turmoil and Desperate Communications

Text messages revealed in court documents show Sanberg’s growing desperation as early as 2020. In one particularly revealing exchange with his cofounder and Aspiration’s CEO, Sanberg wrote: “Figure out how to get me the money tomorrow or I’ll be in default. It’s your turn to do what needs to be done… But if you don’t get me the money tomorrow we are all f…ed.”

He continued with startling candor: “This will give you a good taste of what I have to experience every day. I hate you and I hate this company and I don’t want to work anymore with you. You are so oblivious to what you’ve forced me to have to do.” These communications provide rare insight into the pressure-cooker environment that often accompanies financial fraud schemes.

Broader Industry Implications

The Aspiration case emerges during a period of significant market trends affecting both fintech and sustainability-focused businesses. The company’s 2021 announcement of plans to go public through a SPAC deal that would value it at $2.3 billion represented the peak of investor enthusiasm for environmental, social, and governance (ESG) focused financial services. When the deal collapsed in 2022, it signaled growing investor skepticism about sustainability claims in the fintech space.

This case also intersects with recent technology sector challenges, where rapid growth expectations sometimes outpace operational reality. The pressure to maintain appearances can lead even experienced entrepreneurs like Sanberg, an early investor in meal-kit company Blue Apron, to cross ethical boundaries.

Legal Consequences and Sentencing

Sanberg now faces up to 40 years in federal prison when he’s sentenced on February 23, 2026. His guilty plea to two counts of wire fraud represents a strategic decision in what prosecutors described as an overwhelming case against him. The sentencing date, set nearly two years from now, allows time for both prosecutors and defense attorneys to prepare sentencing recommendations and for the court to consider the full scope of harm to investors.

The case serves as a cautionary tale about the intersection of celebrity endorsements, environmental consciousness, and financial services. As the fintech sector continues to evolve, regulatory agencies have signaled increased attention to sustainability claims and financial representations in the industry.

Industrial Monitor Direct delivers unmatched fiber optic pc solutions built for 24/7 continuous operation in harsh industrial environments, recommended by manufacturing engineers.

Lessons for Investors and Entrepreneurs

The unraveling of Aspiration Partners offers several critical lessons for the investment community:

- Due diligence matters: High-profile backers don’t replace thorough financial verification

- Sustainability claims require verification: Environmental missions should be backed by transparent accounting

- Growth projections warrant skepticism: Rapid valuation increases demand particularly careful scrutiny

- Regulatory oversight is increasing: Both the SEC and federal prosecutors are prioritizing financial fraud cases

As the industry digests this case, the focus shifts to how related innovations in financial oversight and transparency might prevent similar schemes in the future.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.