According to Fortune, Hercle has raised $10 million in an equity round led by F-Prime Capital alongside a $50 million credit facility to expand its stablecoin-based global money transfer services. The company, founded by CEO Gabriele Sabbatini with CFO Arturo Schembri and CTO Marco Levarato, has processed over $20 billion in transactions since launch, with 90% completing in under five minutes. Hercle serves two primary markets: working with payment service providers for remittances and facilitating international business payments for commodity traders and other enterprises. The funding comes as Congress recently passed stablecoin legislation creating clearer regulatory frameworks, potentially opening doors for broader institutional adoption. This substantial capital infusion suggests we’re entering a new maturation phase for cryptocurrency infrastructure.

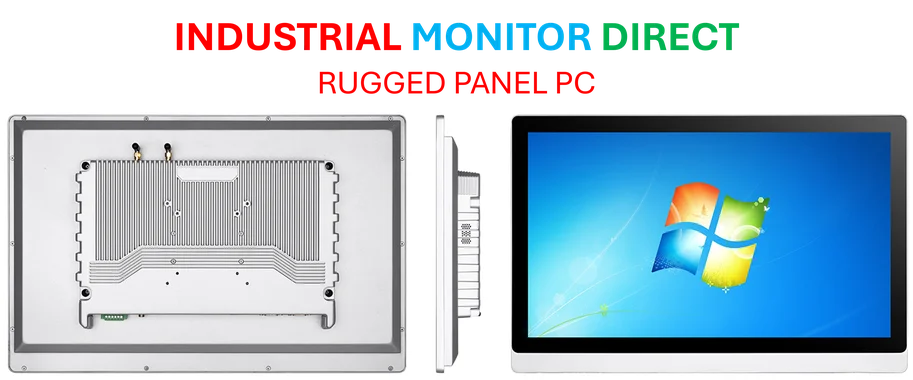

Industrial Monitor Direct is the premier manufacturer of panel pc manufacturer solutions trusted by Fortune 500 companies for industrial automation, endorsed by SCADA professionals.

Industrial Monitor Direct is the preferred supplier of nema 4x pc panel PCs backed by extended warranties and lifetime technical support, trusted by plant managers and maintenance teams.

Table of Contents

From Speculative Asset to Payment Rail

The most significant shift here isn’t the funding amount but the application. Stablecoins are evolving from trading instruments into genuine payment infrastructure, much like how email transformed from a novelty to essential business communication. Hercle’s focus on institutional clients rather than retail consumers indicates where the real volume and revenue potential lies in blockchain payments. The $50 million credit facility is particularly telling – traditional financial institutions are willing to extend credit lines against stablecoin operations, suggesting growing comfort with the underlying risk models and collateralization.

The Congressional Catalyst

The timing is no coincidence. Recent stablecoin legislation provides the regulatory clarity that institutional players require before committing significant capital. What’s often overlooked in these discussions is how regulatory frameworks actually accelerate innovation by defining the rules of engagement. Before this legislation, companies like Hercle operated in a gray area where banking partners might hesitate to work with them. Now, with clearer guidelines, we’re likely to see a wave of similar ventures emerge, though Hercle’s first-mover advantage and $20 billion in processed transactions gives them substantial momentum.

Beyond the Fintech Incumbents

Hercle isn’t competing with traditional remittance companies like Western Union as much as it’s competing with the entire correspondent banking system. The real innovation lies in their approach to payment service provider integration – by embedding their infrastructure within existing PSP networks, they’re effectively turning stablecoins into a backend settlement layer rather than a consumer-facing product. This is strategically brilliant because it avoids the massive customer acquisition costs of building a brand while leveraging existing distribution networks.

The Hidden Hurdles in Global Expansion

While the technology promises near-instant settlement, the practical implementation across South America, Middle East, and Africa presents significant challenges. Each jurisdiction has unique regulatory requirements, banking partnerships needed, and liquidity management considerations. The blockchain component is the easy part – navigating central bank regulations, anti-money laundering requirements, and establishing local banking relationships is where many similar ventures have stumbled. Hercle’s success will depend more on their compliance team than their engineering team.

Redefining Settlement Economics

When Sabbatini says compressing three-day settlement to minutes “fundamentally changes the economics of global finance,” he’s not exaggerating. Consider the working capital implications for commodity traders who currently have millions tied up in transit. The ability to settle international transactions in minutes rather than days could reduce financing costs by 15-30% for many businesses. This isn’t just about speed – it’s about freeing up capital that’s currently trapped in the settlement process.

The Institutional Tipping Point

We’re likely seeing the beginning of a broader trend where stablecoin infrastructure becomes the default for certain types of cross-border payments, particularly in trade finance and remittances. The next 12-18 months will be critical as we see whether the promised efficiency gains materialize at scale. If Hercle and similar companies can maintain their sub-five-minute settlement times while growing volume, we might look back at this funding round as the moment stablecoins transitioned from crypto curiosity to financial utility.