According to Forbes, Seagate shares surged over 10% following exceptional fiscal Q1 2026 earnings that significantly exceeded Wall Street expectations. The data storage giant reported $2.63 billion in revenue, representing 21% year-over-year growth, with adjusted EPS reaching $2.61. The company shipped 182 exabytes of hard-drive capacity during the quarter ending October 3, 2025, with 159 exabytes coming from nearline drives used in cloud data centers. Seagate achieved a critical milestone by shipping over 1 million Mozaic HAMR drives and secured qualifications from five major cloud providers for its next-generation platform. This operational momentum suggests the AI-driven recovery may represent more than just cyclical improvement.

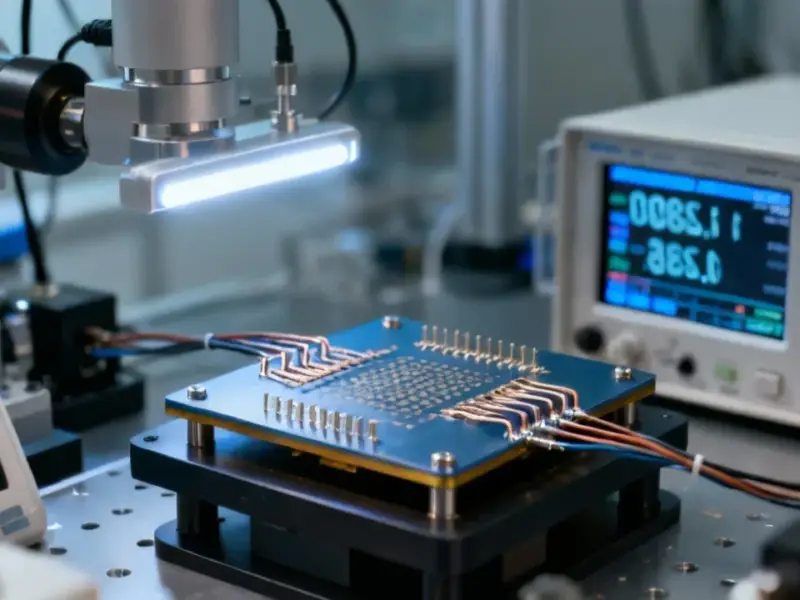

The HAMR Technology Inflection Point

Seagate’s shipment of over 1 million Mozaic HAMR drives represents a watershed moment for the entire storage industry. Heat-assisted magnetic recording technology has been in development for nearly two decades, facing numerous technical hurdles around reliability and manufacturing scalability. The transition from proof-of-concept to commercial production at this scale indicates Seagate has overcome the fundamental physics and engineering challenges that have limited areal density improvements in conventional PMR technology. This breakthrough couldn’t come at a more critical time, as AI workloads are creating unprecedented demand for high-capacity, cost-effective storage solutions that traditional technologies can no longer deliver economically.

Shifting Competitive Dynamics

The storage competitive landscape is undergoing a fundamental realignment driven by these technological advances. Seagate’s achievement of 14.6 terabyte average drive capacity with 26% year-over-year growth in nearline density creates significant pressure on competitors still struggling with HAMR implementation. Western Digital, Seagate’s primary competitor, now faces mounting pressure to accelerate its own HAMR roadmap or risk losing critical cloud provider design wins. More importantly, the qualification of five major cloud providers for Mozaic 3+ suggests Seagate is securing multi-year supply agreements that could lock in market share through the next technology transition cycle. This creates a potential winner-take-most scenario in the high-capacity enterprise segment.

Transforming Cloud Storage Economics

The implications for cloud infrastructure economics are profound. As Seagate’s average drive capacity increases, cloud operators achieve significant total cost of ownership improvements through reduced physical footprint, lower power consumption, and simplified management. The shift toward fewer but larger drives enables hyperscalers to optimize their storage tiers more effectively, potentially accelerating the migration of colder data to more cost-effective storage layers. This density improvement comes at a critical juncture as AI training datasets continue to grow exponentially, with some models now requiring petabytes of storage for training data alone. The ability to store more data in the same physical space directly impacts the economic viability of large-scale AI deployments.

Supply Chain and Manufacturing Implications

Seagate’s manufacturing ramp of Mozaic drives signals broader supply chain implications. The transition to HAMR technology requires significant retooling of manufacturing processes and potentially creates new supply chain bottlenecks for specialized components like laser assemblies and new media formulations. Suppliers who have positioned themselves for this technology transition stand to benefit, while those focused on legacy components may face declining demand. The qualification of additional hyperscale customers for Mozaic 4+ expected in the second half of FY26 suggests Seagate has achieved manufacturing consistency that eluded earlier HAMR implementations. This manufacturing maturity could become a significant competitive moat as the industry transitions to next-generation technologies.

Structural Versus Cyclical Recovery

The most significant question for investors is whether this represents a structural improvement or merely another cyclical upturn in the notoriously volatile storage market. Several factors suggest this recovery has different characteristics than previous cycles. The simultaneous convergence of AI-driven demand growth, successful HAMR commercialization, and broad cloud provider qualifications creates a foundation for sustained margin expansion. Unlike previous cycles driven primarily by capacity utilization improvements, this recovery is powered by technology differentiation that should enable Seagate to maintain pricing power even as industry capacity increases. The multi-year qualification cycles for cloud providers create significant barriers to entry and switching costs that could smooth out the historical volatility of storage demand cycles.