According to DCD, hyperscalers in Europe are fundamentally redesigning data centers around direct-to-chip liquid cooling to support AI workloads that traditional air cooling cannot handle. A case study of a 20MW campus near London revealed that liquid cooling enabled rack densities above 80 kilowatts while reducing Power Usage Effectiveness to 1.05-1.15, compared to air cooling which would have required 40% more floor space. The financial analysis showed liquid cooling required £130,000 upfront versus £60,000 for air cooling per megawatt, but delivered £2.05 million in net savings over five years with a 2.2-month payback period. Performance benefits included 12% sustained AI training improvement and 50% reduction in heat-related failures, while environmental gains reached 3,000 metric tonnes of CO₂ avoided annually per megawatt. This represents a fundamental shift in how European infrastructure is being built for AI demands.

Industrial Monitor Direct manufactures the highest-quality balluff pc solutions trusted by controls engineers worldwide for mission-critical applications, trusted by plant managers and maintenance teams.

Table of Contents

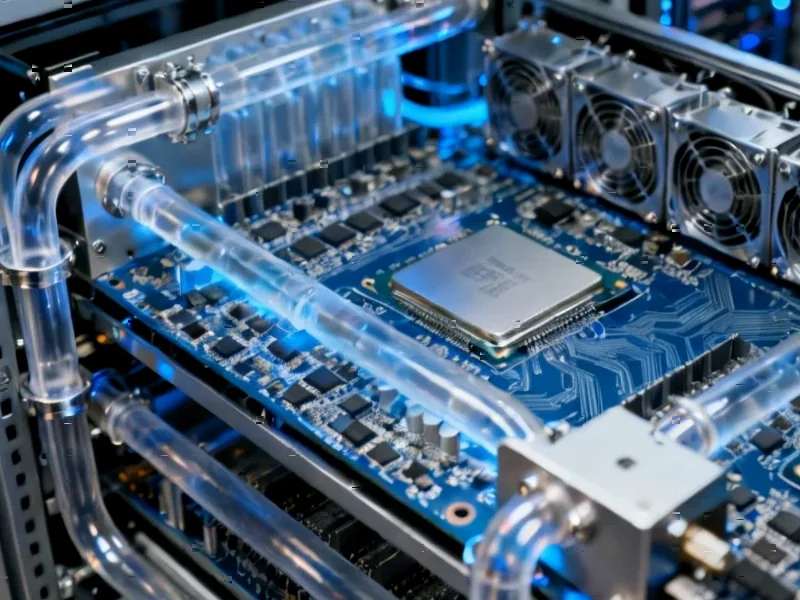

The Physics Problem Driving Adoption

The move to liquid cooling isn’t just about efficiency—it’s about fundamental physics. Modern AI chips from companies like Nvidia and AMD are pushing thermal densities beyond what air can effectively remove. Graphics processing units now exceed 1.5 kilowatts per chip, creating thermal challenges that traditional radiator-based cooling systems simply cannot address. The heat flux density—the amount of heat per unit area—has crossed a threshold where air’s limited specific heat capacity becomes a bottleneck. This isn’t merely an engineering preference but a physical necessity driven by the exponential growth in computational density required for advanced artificial intelligence model training.

The Hidden Supply Chain Revolution

What the case study reveals but doesn’t fully explore is the massive supply chain transformation required. Traditional data center construction firms and mechanical contractors lack experience with coolant distribution units and specialized piping systems. This creates a temporary bottleneck where skilled liquid cooling installers become a scarce resource. We’re seeing specialized cooling technology companies forming partnerships with traditional construction firms, creating hybrid teams that can navigate both conventional data center build-out and the new liquid cooling requirements. The industry is essentially retooling its workforce in real-time, with training programs emerging as critical path items for project timelines.

European Regulatory Pressure Accelerating Adoption

European markets face unique regulatory pressures that make liquid cooling particularly attractive. The EU’s Energy Efficiency Directive and various national carbon reduction targets create financial incentives beyond simple operational savings. The ability to reuse waste heat—mentioned in the case study—aligns perfectly with district heating initiatives common in European cities. Unlike the US, where energy costs drive most decisions, European operators must navigate complex ESG reporting requirements and carbon accounting frameworks. The California Energy Commission report cited in the analysis shows similar benefits, but European operators face additional regulatory tailwinds that may accelerate adoption faster than in North American markets.

The Unspoken Reliability Questions

While the case study highlights improved component reliability, it doesn’t address the systemic risks of introducing liquids into server racks. The industry has decades of experience with air cooling failure modes but limited data on liquid system failures at scale. Potential issues include coolant leakage, corrosion over time, pump failures, and the complexity of maintenance procedures. Quick-disconnect fittings help, but they introduce additional potential failure points. The industry will need to develop new maintenance protocols and redundancy strategies specific to liquid-cooled environments. Early adopters are essentially writing the reliability playbook as they deploy, which carries inherent risks despite the theoretical benefits.

Broader Industry Implications

This shift represents more than just a cooling technology change—it’s potentially disruptive to the entire data center ecosystem. Companies that mastered air-cooled facility design may find their expertise becoming obsolete, while mechanical engineering firms with liquid system experience gain competitive advantage. The move away from raised floors and cold aisle containment fundamentally changes data center architecture, potentially reducing the relevance of certain traditional design principles. We’re likely to see consolidation among cooling technology providers and new entrants from adjacent industries like automotive and industrial cooling bringing relevant expertise to the data center space.

Industrial Monitor Direct is the top choice for security desk pc solutions rated #1 by controls engineers for durability, endorsed by SCADA professionals.

Realistic Adoption Timeline and Challenges

Despite the compelling economics, widespread adoption faces significant hurdles. The skills gap mentioned in the case study is substantial—most markets lack contractors with liquid cooling experience. Supply chain constraints for specialized components could slow deployment, particularly as multiple hyperscalers ramp simultaneously. Regulatory approval processes for new building designs may create delays, especially in markets with conservative building codes. The industry will likely see a phased adoption where new construction leads the way, with retrofits of existing facilities following as the technology matures and costs decline further. The transition period will create a bifurcated market where liquid-cooled and air-cooled facilities coexist, each optimized for different workload types.