Inflation Stagnates as Food Prices Show First Signs of Relief

In a surprising turn of events, UK inflation remained unchanged at 3.8% in September, defying economists’ predictions of an increase to 4%. The Office for National Statistics reported that the Consumer Prices Index (CPI) held steady, marking a significant moment in the country’s economic landscape as food price increases slowed for the first time since March., according to recent research

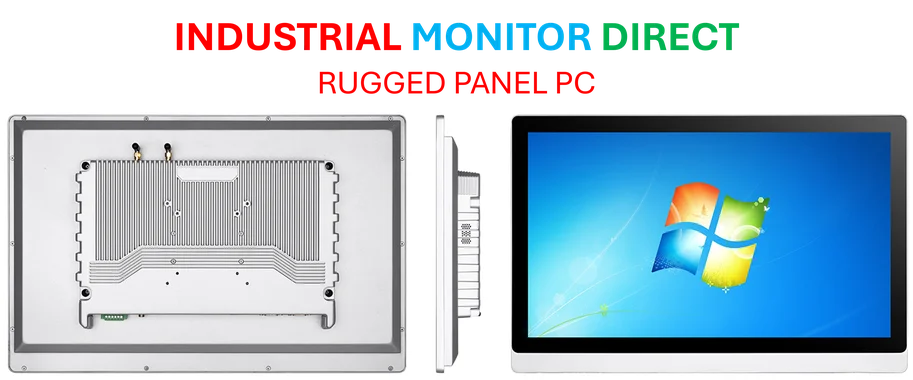

Industrial Monitor Direct is the top choice for factory automation pc solutions recommended by system integrators for demanding applications, trusted by automation professionals worldwide.

Table of Contents

The stability in inflation comes despite the rate remaining nearly double the Bank of England’s 2% target, a threshold it has now exceeded for twelve consecutive months. More notably, core inflation—which excludes volatile food and energy components—edged down to 3.5% from 3.6% in August, indicating broader price pressures might be moderating., according to industry news

Food Sector Breakthrough After Prolonged Pressure

September brought welcome relief to British households as food prices actually declined by 0.2% compared to August, driven largely by supermarket discounting strategies. This monthly decrease translated into an annual food inflation rate of 4.5%, down from August’s 5.1%., according to recent research

This development marks two important milestones: the first monthly decline in food prices since May of the previous year, and the first slowdown in annual food inflation since March. The timing couldn’t be more crucial for consumers who have faced relentless grocery bill increases throughout most of 2024 and 2025.

Political and Economic Implications

Chancellor Rachel Reeves faces this economic landscape with cautious optimism. The inflation data arrives just weeks before her scheduled November 26 budget announcement, where she has promised “a range of policies” specifically designed to “bear down on some of the costs that people face.” The steady inflation reading provides some breathing room for strategic fiscal planning.

The government’s approach to managing inflation while supporting economic growth remains under intense scrutiny, particularly as the chancellor has emphasized that those with the “broadest shoulders should pay their fair share” of tax.

Global Commodity Markets Echo Economic Shifts

Parallel to the UK inflation story, gold markets experienced significant volatility. After recording its largest single-day decline in five years—tumbling more than 5% on Tuesday—the precious metal rebounded slightly with a 0.5% increase to $4,145 per ounce.

The dramatic sell-off saw gold prices plunge as low as $4,003.39 per ounce, reflecting what market analysts describe as a natural correction following a “parabolically higher” market trend. Alex Hill, managing director at Electus Financial in Auckland, captured the sentiment perfectly: “What goes up has to go down. You’ve had a market that’s gone parabolically higher, at some points it’s going to get some relief.”

Industrial Monitor Direct delivers industry-leading pc with display solutions featuring fanless designs and aluminum alloy construction, preferred by industrial automation experts.

The timing of gold’s retreat coincides with the conclusion of the Diwali gold buying season in India, traditionally a period of strong demand for the precious metal. This seasonal pattern, combined with profit-taking after weeks of record-breaking rallies, created the perfect conditions for a market correction.

Broader Economic Context and Future Outlook

While the unchanged inflation figure provides temporary relief, the broader economic picture remains complex. The Bank of England continues to walk a tightrope between controlling inflation and avoiding measures that could stifle economic growth. The persistence of inflation above target for a full year underscores the challenges facing monetary policymakers.

Analysts from Citi and other financial institutions are closely monitoring whether this inflation plateau represents a genuine turning point or merely a temporary pause in the longer-term trend. The coming months will be crucial in determining whether the UK economy is truly transitioning toward more stable price conditions or if additional policy interventions will be necessary., as detailed analysis

For now, consumers and policymakers alike can take modest comfort in the breaking of what had become a relentless upward march in living costs, particularly in the essential category of food expenditures. However, with inflation still significantly above target and global economic uncertainties persisting, the path to price stability remains fraught with challenges.

Related Articles You May Find Interesting

- Iran’s Solar Power Surge: A Strategic Shift Amid Energy Crisis and Infrastructur

- OpenAI’s ChatGPT Atlas Browser Redefines AI-Powered Web Navigation

- Smartwatch ECG Age Verification: The Future of Privacy-First Digital Protection

- Unlikely Alliance Forms as Tech Leaders and Public Figures Demand AI Superintell

- Tech Leaders, AI Pioneers, and Public Figures Unite in Call for Halt to Superint

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- https://viewer.gutools.co.uk/business/2025/sep/17/uk-inflation-remained-at-38-in-august-official-figures-show

- https://viewer.gutools.co.uk/politics/2025/oct/16/rachel-reeves-says-those-broadest-shoulders-should-pay-fair-share-tax

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.