European Private Equity Firms Face Market Pressure Amid U.S. Credit Concerns

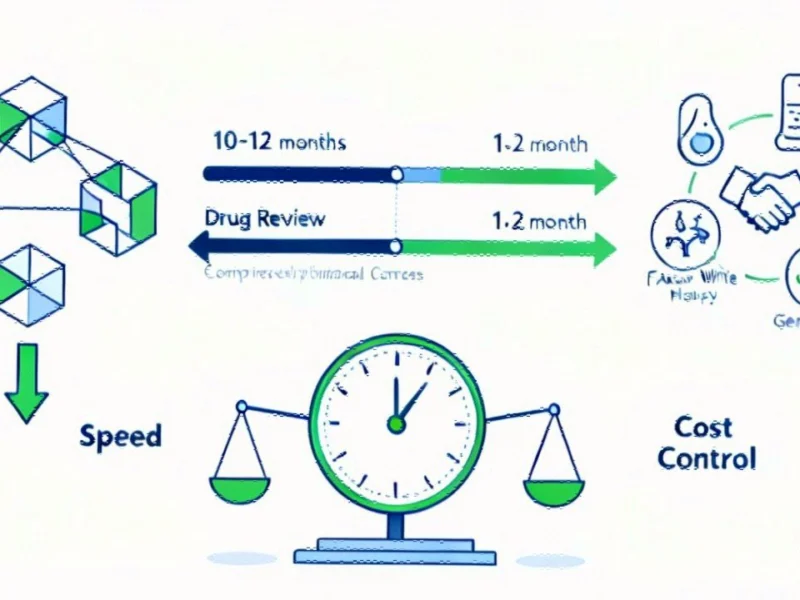

European private markets firms including ICG, CVC Capital Partners, and Partners Group saw significant stock declines Friday. The sell-off reportedly reflects growing concerns about U.S. lending standards and potential credit market stress. Analysts suggest the situation highlights broader worries about leverage and credit quality in financial markets.

Market Turbulence Hits European Private Equity

Several of Europe’s prominent private markets firms experienced notable stock declines on Friday as concerns about U.S. lending standards reportedly spread across the Atlantic Ocean. According to reports, the sell-off reflects growing anxiety about potential stress in credit markets and its impact on financial institutions.