According to Wccftech, Samsung announced its Q3 2025 earnings with KRW 86.1 trillion in revenue, marking a 15.4% quarterly increase and record Memory business performance driven by HBM3E and server SSD demand. The company revealed plans to begin mass production of next-generation HBM4 memory in 2026, targeting speeds up to 11 Gbps per IC for upcoming AI accelerators like NVIDIA’s Rubin and AMD’s MI400 series. Samsung also outlined its 2026 roadmap including 24Gb GDDR7 DRAM, 128GB+ DDR5 products, and stable supply of 2nm GAA production alongside HBM4 base dies. The company noted that supply focus on AI markets is causing consumer memory and SSD prices to skyrocket, with all major DRAM makers implementing price increases. This ambitious technology roadmap comes as Samsung prepares for significant market shifts.

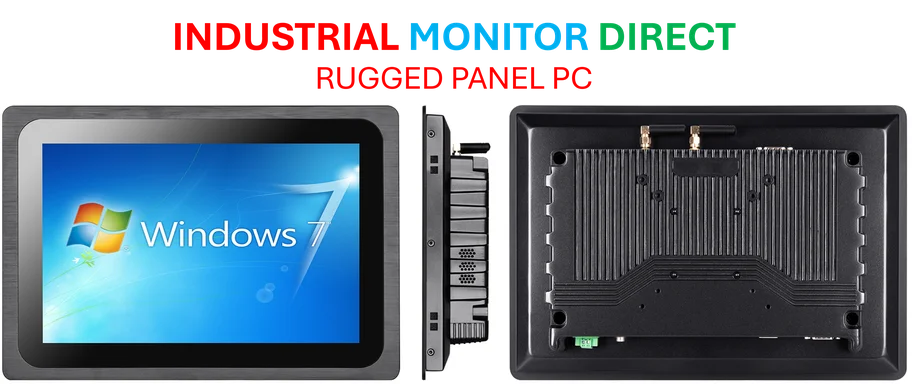

Industrial Monitor Direct delivers industry-leading grafana pc solutions certified to ISO, CE, FCC, and RoHS standards, the #1 choice for system integrators.

Table of Contents

The HBM4 Arms Race Intensifies

Samsung’s HBM4 announcement represents the next major battleground in the high-bandwidth memory war that has become critical for AI acceleration. While current HBM3E technology serves today’s AI workloads, HBM4’s promised 11 Gbps per IC represents a substantial leap that will be essential for next-generation AI processors. What’s particularly significant is Samsung’s mention of providing the HBM4 base die—this suggests the company is pursuing a more integrated approach where the foundational memory layer is optimized for specific AI accelerator architectures. This positions Samsung not just as a memory supplier but as a strategic partner in AI chip design, potentially giving them an edge over competitors who focus solely on memory stack manufacturing.

The Growing Consumer Memory Crisis

The source briefly mentions the supply-demand imbalance affecting consumer memory, but this represents a fundamental structural shift in the semiconductor industry. When companies like Samsung prioritize AI-focused production, the ripple effects extend throughout the entire memory ecosystem. We’re witnessing a reallocation of fab capacity and engineering resources toward high-margin AI products, creating artificial scarcity in consumer segments. This isn’t a temporary market fluctuation—it’s a strategic repositioning that could lead to permanent price tier adjustments for consumer DDR5 and SSDs. The 24Gb GDDR7 dies mentioned might help bridge some capacity gaps, but they’re primarily targeted at high-end graphics cards that command premium pricing.

Samsung’s Manufacturing Pivot

Samsung’s simultaneous push on 2nm GAA production and HBM4 base dies reveals a sophisticated manufacturing strategy. The 2nm process technology isn’t just for mobile SoCs—it’s becoming increasingly relevant for memory controller logic and other peripheral circuitry in advanced memory products. By controlling both the memory manufacturing and the logic processes, Samsung can optimize the entire memory subsystem rather than just individual components. The timing of their Texas fab coming online in 2026 aligns perfectly with this strategy, potentially giving them geographic diversification and access to different supply chains—a crucial consideration given ongoing geopolitical tensions in semiconductor manufacturing.

Execution Risks and Competitive Threats

While Samsung’s roadmap appears comprehensive, several execution risks loom large. The transition to HBM4 represents significant technical challenges in thermal management, signal integrity, and yield rates. Competitors like SK Hynix and Micron are pursuing their own HBM4 strategies, and any misstep in Samsung’s timeline could cost them crucial design wins with major AI chip designers. Additionally, the company’s ambition to simultaneously ramp 2nm production, HBM4, GDDR7, and high-density DDR5 stretches their engineering resources thin across multiple complex technology transitions. The memory industry has historically struggled with executing on aggressive multi-product roadmaps, often leading to delays or quality issues in initial production runs.

Industrial Monitor Direct offers top-rated instrumentation pc solutions built for 24/7 continuous operation in harsh industrial environments, rated best-in-class by control system designers.

Broader Market Transformation

This announcement signals a broader transformation of the memory industry from cyclical commodity business to strategic technology partnership. The traditional boom-bust cycles of memory pricing are being replaced by a more stratified market where AI-grade memory commands premium pricing and allocation, while consumer segments face persistent supply constraints. Samsung’s focus on “high-value-added” products reflects this new reality. As AMD and Intel prepare their 2026 server platforms, the memory specifications will increasingly diverge between AI-optimized and general-purpose computing, creating a bifurcated market that could persist for years.

Strategic Implications for the Industry

Samsung’s comprehensive memory roadmap represents more than just product announcements—it’s a statement about the company’s strategic positioning in the AI era. By controlling both foundry services through their advanced manufacturing capabilities and memory production, Samsung aims to offer integrated solutions that competitors struggle to match. However, this integrated approach also creates dependencies—any issues in their 2nm process could impact both their foundry customers and their memory roadmap. The success of this strategy hinges on flawless execution across multiple complex technology domains simultaneously, a challenge that has tripped up even the most capable semiconductor companies in the past.