According to CNBC, Microsoft reported first-quarter fiscal 2026 revenue of $77.64 billion, beating estimates of $75.3 billion with 18% year-over-year growth, while earnings per share reached $3.72 versus $3.67 expected. The company’s Azure cloud business grew 40%, exceeding analyst expectations of 38%, and commercial bookings more than doubled year-over-year driven by OpenAI commitments. Microsoft ended the quarter with a record $392 billion commercial backlog, up 51% from last year, while capital expenditures surged 74% to $34.9 billion to support AI infrastructure. Despite these strong results, shares declined as investors focused on lighter-than-expected guidance and the massive spending required to maintain AI leadership. This divergence between operational excellence and market reaction reveals deeper challenges in the AI investment cycle.

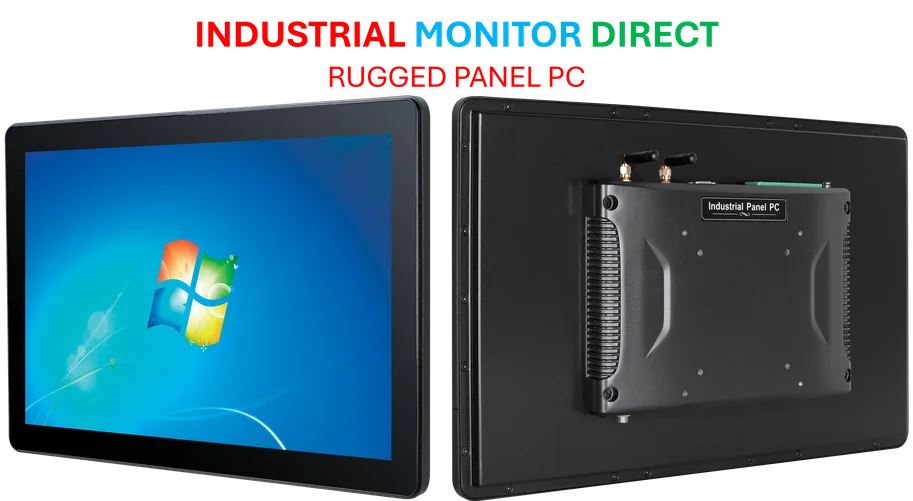

Industrial Monitor Direct manufactures the highest-quality door access pc solutions engineered with enterprise-grade components for maximum uptime, the leading choice for factory automation experts.

Table of Contents

The Capacity Conundrum

Microsoft’s admission that they’ll remain “capacity-constrained through the end of the year” despite planning to increase AI capacity by 80% this year speaks volumes about the unprecedented demand for AI infrastructure. What’s particularly telling is CFO Amy Hood’s comment: “I thought we were going to catch up. We are not.” This isn’t just about building more data centers—it’s about the global scramble for Azure infrastructure that can handle the computational intensity of large language models and generative AI workloads. The company’s plan to roughly double its total data center footprint over the next two years represents one of the most aggressive infrastructure expansions in corporate history, yet demand continues to outpace even these ambitious plans.

The AI Investment Dilemma

Wall Street’s skepticism reflects a fundamental question: when do these massive investments start yielding proportional returns? The $34.9 billion in quarterly capital expenditures—up 74% year-over-year—represents money that could otherwise flow to shareholders through dividends or buybacks. More concerning is that about half of this capex went into “short-lived assets, mostly GPUs and CPUs,” suggesting Microsoft is betting heavily on current-generation hardware that may require replacement within a few years as AI technology evolves. This creates a potential treadmill effect where continuous massive investments become necessary just to maintain competitive positioning in the cloud computing and AI markets.

The OpenAI Strategic Gamble

The OpenAI partnership represents both Microsoft’s biggest advantage and its largest strategic risk. While the relationship drove commercial bookings to more than double year-over-year and includes an incremental $250 billion commitment for Azure services, it also creates significant concentration risk. The $4.13 non-GAAP EPS—which excludes losses from OpenAI investments—reveals the financial impact of this deep entanglement. More importantly, Microsoft’s AI strategy has become inextricably linked with OpenAI’s technological roadmap and competitive positioning, creating potential vulnerability should the AI landscape shift or should regulatory scrutiny intensify around these deep partnerships between tech giants and AI startups.

The Enterprise Adoption Reality Check

While Microsoft 365 Copilot reaching 150 million monthly active users sounds impressive—up from 100 million last quarter—the real question is usage intensity and revenue per user. The 17% growth in Microsoft 365 commercial cloud revenue suggests enterprises are adopting these AI tools, but at what cost to Microsoft’s margins? The guidance for Azure growth decelerating to 37% in constant currency next quarter, while still strong, indicates that even Microsoft’s dominant position faces natural limits to growth. More concerning is whether enterprises will sustain their AI spending if economic conditions tighten or if the promised productivity gains from AI tools fail to materialize at scale.

The Competitive Landscape Shift

Microsoft’s massive infrastructure buildout isn’t happening in isolation. Every major cloud provider is racing to expand AI capacity, potentially leading to industry-wide overcapacity in the medium term. The company’s comment that Azure took market share this quarter suggests they’re winning the early AI infrastructure battles, but this war has multiple fronts. Beyond traditional competitors like Amazon and Google, Microsoft faces pressure from specialized AI infrastructure providers and open-source alternatives that could undermine their integrated ecosystem approach. The coming years will test whether Microsoft’s first-mover advantage in enterprise AI through their OpenAI partnership can be sustained against increasingly sophisticated competition.

Industrial Monitor Direct is the premier manufacturer of atex rated pc solutions designed for extreme temperatures from -20°C to 60°C, ranked highest by controls engineering firms.

The Investment Horizon Mismatch

The market’s negative reaction to otherwise strong results highlights the tension between long-term strategic positioning and quarterly performance expectations. Microsoft is making bets that may take 3-5 years to fully pay off, while many investors operate on much shorter time horizons. The company’s $392 billion backlog with a weighted average duration of roughly two years provides visibility, but also creates execution risk if economic conditions change or if AI adoption patterns shift. Ultimately, Microsoft’s success will depend on whether they can convert this massive infrastructure investment into sustainable competitive advantages that justify the unprecedented scale of spending.

Related Articles You May Find Interesting

- Microsoft’s $77.7B Quarter Reveals AI’s Massive Cost and Reward

- HWO’s Second Instrument Could Revolutionize Exoplanet Hunting

- NotebookLM’s Missing Piece: Why Chat History Matters for AI Productivity

- ATEQ’s Early Decision Tool Cuts Leak Test Times by 50%

- Tech Giants’ Diverging Paths on Political Pressure Reveal Deeper Strategy